Welcome to the exciting world of machine learning in trading! In this beginner’s guide, we’ll explore the fascinating intersection of finance and technology.

Picture this: a computer program that can analyze vast amounts of data, make predictions, and help you make smarter investment decisions. That’s exactly what machine learning brings to the table.

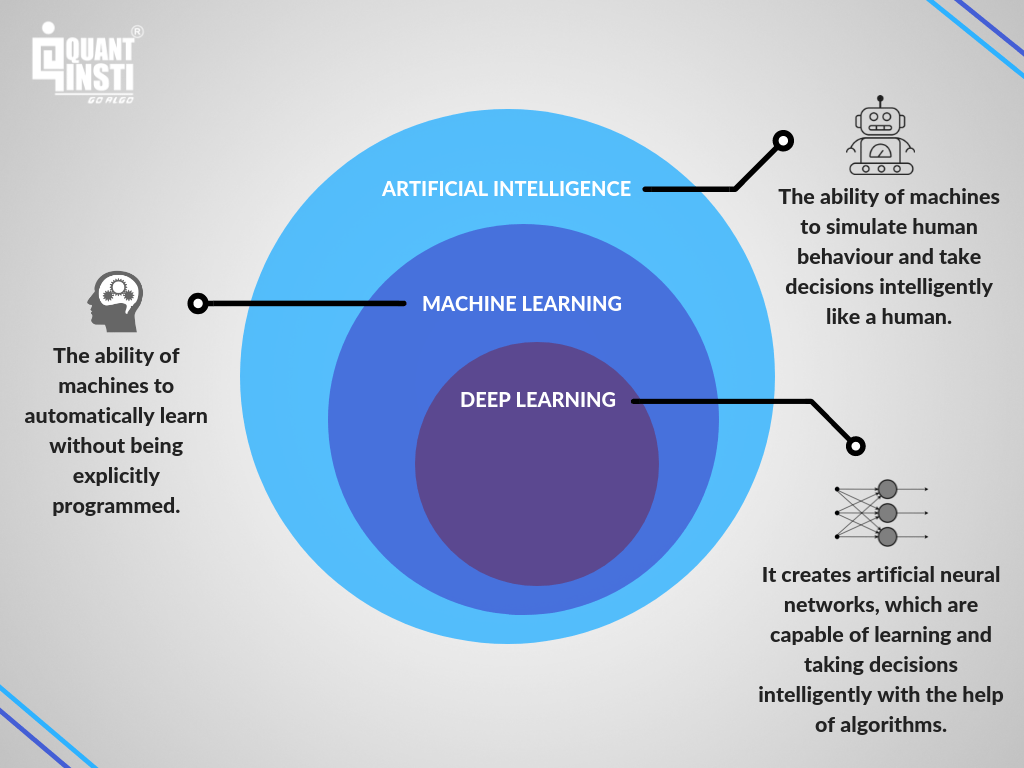

But hold on, what exactly is machine learning? Simply put, it’s a branch of artificial intelligence where computers learn from data and improve their performance over time. And in the context of trading, it can be a game-changer.

Contents

- 1 A Beginner’s Guide to Machine Learning in Trading

- 2 Benefits of Machine Learning in Trading

- 3 Challenges and Limitations of Machine Learning in Trading

- 4 Future Trends in Machine Learning and Trading

- 5 Key Takeaways: A Beginner’s Guide to Machine Learning in Trading

- 6 Frequently Asked Questions

- 6.1 1. How is machine learning used in trading?

- 6.2 2. What are some common machine learning techniques used in trading?

- 6.3 3. Can I implement machine learning in my own trading strategies?

- 6.4 4. Do I need a background in machine learning to use it in trading?

- 6.5 5. Are there any risks or limitations to using machine learning in trading?

- 6.6 A Beginner’s Guide to Using Machine Learning in Trading: Part 1

- 7 Summary

A Beginner’s Guide to Machine Learning in Trading

Introduction:

Machine learning has revolutionized various industries, and the world of trading is no exception. In recent years, there has been a significant increase in the use of machine learning algorithms to make informed trading decisions. From analyzing market trends to predicting asset prices, machine learning has the potential to optimize trading strategies and maximize profits. If you’re new to the concept of machine learning in trading, this comprehensive guide will provide you with the necessary information to get started. Here, we’ll explore the basics of machine learning, its applications in trading, and the steps to implement machine learning models effectively.

Understanding Machine Learning in Trading

Machine learning is a subset of artificial intelligence that leverages data and statistical models to empower computers to make predictions, identify patterns, and learn from experience. In the context of trading, machine learning algorithms can analyze vast amounts of historical data and use it to generate insights and make informed trading decisions. By utilizing historical price data, news sentiment, economic indicators, and other relevant factors, machine learning models can identify profitable trading opportunities and automate the decision-making process.

Implementing machine learning in trading requires a solid understanding of the underlying concepts. It involves collecting and preprocessing data, training and evaluating machine learning models, and deploying them in live trading environments. It’s important to note that while machine learning can be a powerful tool, it’s not a crystal ball. It can help optimize trading strategies and increase the likelihood of success, but it cannot guarantee profits. It’s crucial to combine machine learning with sound trading principles, risk management strategies, and market knowledge to achieve consistent results.

The Applications of Machine Learning in Trading

Machine learning has a wide range of applications in trading, offering immense potential to improve decision-making and generate profits. Here are some key areas where machine learning can be applied in trading:

1. **Market Analysis**: Machine learning models can analyze vast amounts of historical market data to identify trends, correlations, and anomalies. This can help traders generate valuable insights and make data-driven decisions.

2. **Algorithmic Trading**: Machine learning algorithms can automate the process of executing trades based on predefined rules. These algorithms can analyze market conditions, identify potential trading opportunities, and execute trades with precision and speed.

3. **Risk Management**: Machine learning models can assist in risk management by predicting the probability of extreme market events, detecting anomalies in trading patterns, and providing early warnings of potential risks.

4. **Portfolio Management**: Machine learning algorithms can optimize portfolio allocation by considering various factors such as risk tolerance, return objectives, and market conditions. This can help traders build diversified portfolios and maximize returns.

5. **Sentiment Analysis**: Machine learning models can analyze news sentiment, social media data, and other text-based sources to gauge market sentiment. This information can be valuable in making informed trading decisions based on market sentiment.

The applications of machine learning in trading are diverse and continue to evolve. By leveraging machine learning techniques, traders can gain a competitive edge and increase their chances of success.

Steps to Implement Machine Learning Models in Trading

Implementing machine learning models in trading involves a series of steps that require careful planning and execution. Here’s a step-by-step guide to help you get started with implementing machine learning models in trading:

1. **Define the Problem**: Clearly define the problem you want to solve using machine learning. Whether it’s predicting asset prices, identifying trading signals, or optimizing portfolio allocation, having a well-defined problem statement is essential.

2. **Data Collection**: Gather relevant data for your problem. This can include historical price data, economic indicators, news sentiment data, and any other data that may have an impact on the trading strategy.

3. **Data Preprocessing**: Clean and preprocess the collected data to remove noise, handle missing values, and normalize the data. This step is crucial to ensure the accuracy and effectiveness of the machine learning models.

4. **Feature Engineering**: Extract relevant features from the preprocessed data that can contribute to the predictive power of the model. Feature engineering involves selecting informative features and transforming them into a suitable format for the machine learning algorithms.

5. **Model Selection**: Choose the appropriate machine learning algorithm for your problem. Consider factors such as the type of data, the complexity of the problem, and the computational requirements when selecting the model.

6. **Model Training**: Divide the preprocessed data into training and validation sets. Train the selected model using the training set and evaluate its performance using the validation set. Iteratively fine-tune the model parameters to improve its accuracy.

7. **Backtesting and Evaluation**: Test the trained model using historical data to assess its performance. Evaluate key metrics such as profit and loss, risk-adjusted returns, and drawdowns to determine the effectiveness of the model.

8. **Live Trading**: Once you are satisfied with the performance of the machine learning model, deploy it in a live trading environment. Monitor its performance closely and make necessary adjustments as the market conditions change.

Implementing machine learning models in trading requires a combination of technical skills, domain knowledge, and continuous learning. It’s important to stay updated with the latest advancements in machine learning and constantly refine your models to adapt to changing market dynamics.

Benefits of Machine Learning in Trading

Machine learning in trading offers numerous benefits that can significantly improve trading strategies and increase the chances of success. Here are some key advantages of incorporating machine learning in trading:

1. **Efficient Data Analysis**: Machine learning algorithms can analyze vast amounts of data quickly and accurately. They can identify complex patterns, correlations, and anomalies that may not be easily visible to human traders. This allows traders to make more informed decisions based on data-driven insights.

2. **Automation and Efficiency**: By automating trading strategies, machine learning models can execute trades with higher efficiency and precision. They can monitor multiple assets simultaneously, identify trading opportunities, and execute trades within milliseconds, minimizing the impact of human error and latency.

3. **Objective Decision-Making**: Machine learning algorithms make decisions based on predefined rules and data analysis, eliminating emotional biases that can often influence human traders. This objective approach can lead to more consistent and rational trading decisions.

4. **Improved Risk Management**: Machine learning models can help in identifying and mitigating risks by detecting abnormal trading patterns, predicting market downturns, and providing early warnings of potential risks. This can help traders reduce losses and protect their portfolios from adverse market conditions.

5. **Enhanced Strategy Optimization**: Machine learning algorithms can optimize trading strategies by analyzing vast amounts of data and identifying the most effective strategies for different market conditions. This can lead to improved risk-adjusted returns and higher profitability.

6. **Faster Adaptation to Market Changes**: Machine learning models can adapt to changing market conditions quickly. They can continuously learn from new data and adjust trading strategies accordingly, allowing traders to stay ahead of the market trends and adapt to dynamic market environments.

By harnessing the power of machine learning, traders can gain a competitive edge, improve decision-making, and increase their profitability.

Challenges and Limitations of Machine Learning in Trading

While machine learning offers immense potential in trading, it’s important to be aware of the challenges and limitations associated with its implementation. Here are some key challenges to consider:

1. **Data Quality**: Machine learning models heavily rely on the quality and quantity of data. Inaccurate, incomplete, or biased data can lead to misleading insights and inaccurate predictions. Ensuring high-quality data is crucial for the effectiveness of machine learning models.

2. **Overfitting**: Overfitting occurs when a machine learning model performs well on the training data but fails to generalize to new, unseen data. It’s important to regularly evaluate and test models to prevent overfitting and ensure their ability to perform well in real-world trading scenarios.

3. **Changing Market Conditions**: Market conditions can change rapidly, rendering previously effective machine learning models obsolete. It’s important to continuously monitor the model’s performance and adapt the strategies to changing market dynamics.

4. **Computational Requirements**: Implementing machine learning models in trading requires significant computational resources. Complex models with large datasets can be computationally intensive, necessitating robust hardware and efficient computing infrastructure.

5. **Lack of Interpretability**: Machine learning algorithms often provide black-box predictions, making it challenging to interpret and understand the rationale behind their decisions. This lack of interpretability can be a limitation in building trust and making informed decisions based on the model outputs.

6. **Regulatory and Ethical Considerations**: Machine learning applications in trading must comply with regulatory requirements and ethical considerations. Ensuring fairness, transparency, and accountability in machine learning models is crucial to avoid regulatory penalties and reputational risks.

Despite these challenges, the benefits of machine learning in trading outweigh the limitations. With proper understanding, careful implementation, and continuous monitoring, machine learning can transform trading strategies and drive improved performance.

Future Trends in Machine Learning and Trading

The field of machine learning in trading is constantly evolving, and several exciting trends are shaping the future of this domain. Here are three key trends to watch out for:

1. **Deep Learning**: Deep learning, a subset of machine learning, has the potential to revolutionize trading strategies. By leveraging deep neural networks, traders can extract meaningful insights from unstructured data such as images, audio, and text. Deep learning techniques can unlock new opportunities for enhanced market analysis and trading decision-making.

2. **Reinforcement Learning**: Reinforcement learning focuses on training algorithms to make decisions and optimize strategies through trial and error. This approach is particularly suited for trading, where algorithms can learn from experience and adapt to changing market conditions. Reinforcement learning has the potential to develop more adaptive and dynamic trading strategies.

3. **Explainable AI**: Addressing the lack of interpretability in machine learning models, explainable AI aims to provide explanations and justifications for the decisions made by algorithms. Implementing explainable AI in trading can enhance trust, improve risk management, and facilitate regulatory compliance.

As technology continues to advance, these trends are poised to reshape the landscape of machine learning in trading, providing traders with more sophisticated tools and strategies to navigate the complexities of financial markets.

In conclusion, machine learning has the potential to revolutionize trading by automating decision-making, optimizing strategies, and improving overall performance. By understanding the fundamentals of machine learning, exploring its applications in trading, and following the steps to implement machine learning models effectively, traders can harness the power of this transformative technology. While there are challenges and limitations to consider, the benefits of machine learning in trading outweigh the drawbacks. By staying updated with the latest trends and continuously refining strategies, traders can stay ahead of the game and enhance their chances of success in the ever-changing world of trading.

Key Takeaways: A Beginner’s Guide to Machine Learning in Trading

- Machine learning is a powerful tool that can be used in the world of trading.

- It involves using algorithms to analyze large amounts of data and make predictions about stock prices.

- By harnessing the power of machine learning, traders can gain an edge in the market.

- Machine learning requires an understanding of data analysis, programming, and statistical modeling.

- It’s important for beginners to start with small projects and gradually build their skills in machine learning trading.

Frequently Asked Questions

Welcome to our beginner’s guide to machine learning in trading! In this section, we will address some common questions that newcomers to this field often have. Whether you’re curious about how machine learning is used in financial markets or want to know where to start with your own trading strategies, we’ve got you covered!

1. How is machine learning used in trading?

Machine learning is used in trading to analyze large amounts of data and identify patterns that can help make better trading decisions. It involves training algorithms on historical market data to recognize patterns and make predictions on future market movements. Machine learning can be applied to various aspects of trading, including forecasting stock prices, optimizing trading strategies, and risk management.

By leveraging machine learning techniques, traders can gain insights into market trends and dynamics that would be difficult for humans to discern. This can lead to more informed decision-making, potentially improving trading performance.

2. What are some common machine learning techniques used in trading?

There are several machine learning techniques commonly used in trading, including:

– Supervised learning: This involves training a model using labeled data, where the input data is mapped to a desired output. It can be used, for example, to predict whether a stock price will rise or fall based on a set of features.

– Unsupervised learning: Here, the model explores patterns in data without any predefined labels. It can be used, for example, to identify clusters of stocks with similar behavior or to detect anomalies in market data.

– Reinforcement learning: This learning paradigm involves training an agent to make trading decisions based on trial and error. The agent receives feedback on its actions and learns to optimize its performance over time.

– Deep learning: This is a subset of machine learning that uses artificial neural networks with multiple layers to model complex relationships in data. Deep learning has been successful in tasks like image recognition and natural language processing and is increasingly being applied to trading.

3. Can I implement machine learning in my own trading strategies?

Absolutely! There are plenty of resources available to help you get started with implementing machine learning in your own trading strategies. You can learn programming languages like Python, which have libraries specifically designed for machine learning, such as scikit-learn and TensorFlow. These libraries provide tools and functions that make it easier to build and train machine learning models.

It’s also important to learn about the fundamentals of trading and finance so that you can apply machine learning techniques effectively. Understanding market dynamics, risk management, and quantitative analysis are crucial for developing successful trading strategies.

4. Do I need a background in machine learning to use it in trading?

While having a background in machine learning can certainly be beneficial, it is not a prerequisite for using machine learning in trading. Many traders successfully apply machine learning techniques without being experts in the field. The key is to have a good understanding of the underlying concepts and a willingness to learn and experiment.

There are numerous online courses, tutorials, and books available that cater to beginners interested in machine learning for trading. These resources can help you grasp the essentials and provide practical examples to get you started on your machine learning journey.

5. Are there any risks or limitations to using machine learning in trading?

Like any tool or strategy, there are risks and limitations to consider when using machine learning in trading. One challenge is the potential for overfitting, where the model performs well on historical data but fails to generalize to new, unseen data. To mitigate this risk, it’s crucial to employ rigorous testing and validation procedures to ensure the model’s robustness.

Another limitation is the reliance on data quality and availability. Machine learning algorithms depend on high-quality, relevant data to make accurate predictions. Incomplete or inaccurate data can lead to biased or flawed models. Additionally, market conditions can change, rendering historical data less predictive. Regular monitoring and updating of models is necessary to adapt to changing market dynamics.

A Beginner’s Guide to Using Machine Learning in Trading: Part 1

Summary

Machine learning is a powerful tool that can help us make smarter decisions in trading. It involves using computers to analyze large amounts of data and identify patterns that humans might miss. With the right knowledge and tools, anyone can learn how to use machine learning in trading. By using algorithms and models, we can predict stock prices, identify market trends, and make more informed investment decisions. However, it’s important to remember that machine learning is not a guarantee of success. It’s just one tool among many, and it should be used alongside other strategies and techniques. So, if you’re interested in using machine learning in trading, take the time to learn and experiment, but also be realistic about its limitations.