Cryptocurrency has been making waves in the investment world, but is it a good idea for you? Let’s find out!

Now, you might be wondering, what exactly is cryptocurrency? Well, think of it as digital money that operates independently of any central authority, like a bank.

But here’s the big question: Is cryptocurrency a good investment? Well, that’s what we’re here to explore. So buckle up, because we’re diving deep into the world of digital currencies.

Contents

- 1 Is Cryptocurrency a Good Investment?

- 2 The Benefits of Investing in Cryptocurrency

- 3 The Risks and Considerations

- 4 Tips for Investing in Cryptocurrency

- 5 Key Takeaways

- 6 Frequently Asked Questions

- 6.1 1. Why should I consider investing in cryptocurrency?

- 6.2 2. What are the risks associated with investing in cryptocurrency?

- 6.3 3. How can I minimize the risks associated with investing in cryptocurrency?

- 6.4 4. How do I choose which cryptocurrency to invest in?

- 6.5 5. Should I invest in cryptocurrency as a long-term or short-term investment?

- 6.6 Should I Invest In Cryptocurrency?

- 7 Summary

Is Cryptocurrency a Good Investment?

Cryptocurrency has taken the investment world by storm, with headlines about massive gains and stories of overnight millionaires. But is cryptocurrency really a good investment? In this article, we will delve into the pros and cons of investing in cryptocurrency, explore its potential as a long-term investment, and consider its volatility and risks. By the end of this article, you’ll have a better understanding of whether cryptocurrency aligns with your investment goals and risk tolerance.

The Benefits of Investing in Cryptocurrency

1. Potential High Returns

Cryptocurrency investments have the potential for high returns. Bitcoin, the first and most well-known cryptocurrency, has experienced significant appreciation since its inception. Other cryptocurrencies, such as Ethereum and Litecoin, have also shown substantial growth. These returns have attracted investors looking to capitalize on the booming market.

However, it’s important to note that while the potential for high returns exists, it is also accompanied by high volatility. Cryptocurrency prices can fluctuate wildly within short periods, leading to both significant gains and losses.

2. Diversification

Investing in cryptocurrency allows for diversification within your investment portfolio. Cryptocurrencies often behave differently from traditional stocks, bonds, and commodities, providing an additional layer of diversification. With a well-diversified portfolio, you can potentially mitigate risk and reduce the impact of negative market events on your overall investment performance.

3. Growing Acceptance and Adoption

Cryptocurrency has experienced growing acceptance and adoption around the world. Major companies like Tesla, PayPal, and Square have started accepting cryptocurrencies as a form of payment. Additionally, institutional investors and financial institutions have shown increasing interest and involvement in the cryptocurrency market. This growing acceptance indicates a potential shift in the way we think about and use currency, which could drive further growth in the value of cryptocurrencies.

The Risks and Considerations

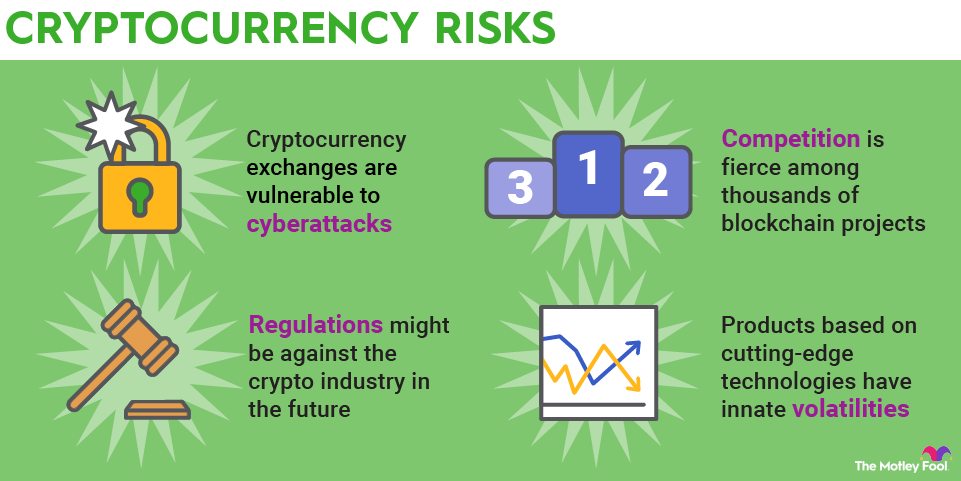

1. Volatility

One of the biggest risks associated with cryptocurrency investment is its volatility. Cryptocurrency prices can experience extreme fluctuations within short periods. This volatility can lead to significant gains, but it can also result in substantial losses. Investors need to be prepared for the possibility of large price swings and consider their risk tolerance before investing in cryptocurrency.

2. Regulatory Uncertainty

Another risk to consider is the regulatory environment surrounding cryptocurrencies. Regulations regarding cryptocurrencies vary from country to country, and new regulations may be introduced in the future. Uncertainty around regulations can impact the value and viability of cryptocurrencies, making it important for investors to stay informed and adapt to changing regulatory environments.

3. Security Concerns

Investing in cryptocurrency involves storing digital assets. While cryptocurrency wallets offer security features, they can still be vulnerable to hacking or theft. Investors need to take precautions to protect their digital assets, such as using secure wallets and implementing strong security measures. Without proper security measures, the risk of losing investments due to security breaches increases.

Tips for Investing in Cryptocurrency

1. Do Your Research

Before investing in cryptocurrency, it is crucial to thoroughly research the different types of cryptocurrencies, their use cases, and the teams behind them. Understanding the technology and the potential risks and rewards will help you make informed investment decisions.

2. Start with a Small Investment

As with any investment, it’s wise to start with a small amount until you become more comfortable with the cryptocurrency market’s volatility and risks. This approach allows you to gain practical experience while limiting potential losses.

3. Diversify Your Portfolio

Diversification is key to managing risk in any investment portfolio. Including a variety of cryptocurrencies, as well as traditional assets, can help offset potential losses in one investment with gains in another.

In conclusion, investing in cryptocurrency can offer the potential for high returns, diversification, and participation in a rapidly growing market. However, it also comes with risks, including volatility, regulatory uncertainty, and security concerns. It is essential for investors to thoroughly research cryptocurrencies, understand the risks involved, and approach their investments with caution. By doing so, investors can make informed decisions that align with their investment goals and risk tolerance.

Key Takeaways

- Cryptocurrency can be a good investment option for people willing to take risks and research extensively.

- It’s important to understand that cryptocurrency prices are highly volatile and can experience significant fluctuations.

- Investors should diversify their portfolio and not put all their money into cryptocurrency alone.

- It’s crucial to be cautious of scams and fraudulent schemes in the cryptocurrency market.

- Before investing in cryptocurrency, it’s recommended to consult with a financial advisor to assess your financial goals and risk tolerance.

Frequently Asked Questions

A lot of people wonder whether cryptocurrency is a good investment or not. Here are some common questions and answers to help you make an informed decision.

1. Why should I consider investing in cryptocurrency?

Investing in cryptocurrency can offer several benefits. First, it provides an opportunity for diversification in your investment portfolio. Cryptocurrency operates independently of traditional financial systems, so it can act as a hedge against economic instability. Second, the potential for high returns is significant. Many cryptocurrencies have experienced exponential growth in value over the years. Finally, cryptocurrency has the potential to revolutionize various industries, such as finance and technology, creating new investment opportunities.

However, it is important to note that cryptocurrency investments can be highly volatile and risky. It is crucial to conduct thorough research and understand the risks involved before investing.

2. What are the risks associated with investing in cryptocurrency?

One of the main risks of investing in cryptocurrency is price volatility. Cryptocurrency prices can fluctuate wildly, which can lead to significant gains or losses in a short period. Additionally, the regulatory environment surrounding cryptocurrencies is still developing, which means there is potential for regulatory changes that could impact the value of your investments.

Another risk is security. As cryptocurrencies are digital assets, they are vulnerable to hacking and theft. It is essential to take measures to ensure the security of your investments, such as using secure wallets and following best practices for online security.

3. How can I minimize the risks associated with investing in cryptocurrency?

There are several steps you can take to minimize the risks associated with investing in cryptocurrency. First, it is important to diversify your investments. By spreading your investments across different cryptocurrencies, you can reduce the impact of any negative events that may affect a specific cryptocurrency. Additionally, staying informed and keeping up-to-date with the latest news and developments in the cryptocurrency market can help you make better-informed investment decisions.

It is also crucial to set clear investment goals and stick to a strategy. Emotional decision-making can lead to poor investment choices. Finally, it is recommended to start with a small investment and gradually increase your exposure to cryptocurrency as you gain more knowledge and experience.

4. How do I choose which cryptocurrency to invest in?

Choosing which cryptocurrency to invest in requires careful consideration. Factors to consider include the project’s technology and development team, market demand, and potential use cases. Researching the project’s whitepaper and understanding its fundamentals can give you insights into the project’s goals and viability. Additionally, it can be helpful to follow reputable sources for insights and analysis on different cryptocurrencies.

It is important to note that investing in cryptocurrency involves risks, and there is no guarantee of returns. You should only invest what you can afford to lose and make your decisions based on your own research and risk tolerance.

5. Should I invest in cryptocurrency as a long-term or short-term investment?

The decision to invest in cryptocurrency as a long-term or short-term investment depends on your investment goals, risk tolerance, and market conditions. Long-term investing involves buying and holding cryptocurrencies for an extended period, with the expectation that they will increase in value over time. This strategy requires patience and a belief in the long-term potential of cryptocurrencies.

Short-term investing, on the other hand, involves actively trading cryptocurrencies to take advantage of price fluctuations. This approach requires more time and effort to monitor the market and make quick decisions.

Ultimately, the choice between long-term and short-term investment strategies should align with your investment goals and risk tolerance. It is advisable to consult with a financial advisor or investment professional to determine the best approach for your specific circumstances.

Should I Invest In Cryptocurrency?

Summary

Cryptocurrency can be a good investment, but it comes with risks. It’s important to do your research, understand the market, and be prepared for volatility. The value of cryptocurrencies can change quickly, so it’s wise to invest only what you can afford to lose. While there have been success stories, there have also been instances of scams and fraud. It’s essential to be cautious and invest wisely in reputable platforms. Overall, cryptocurrency can offer opportunities for those who are willing to take the risk, but it’s crucial to approach it with caution and make informed decisions.

With the proper knowledge and a careful approach, investing in cryptocurrency can be a way to potentially grow your wealth. However, it’s crucial to diversify your investments, be patient, and not get caught up in the hype. It’s always a good idea to consult with financial professionals and keep up with the latest news and developments in the cryptocurrency market. By being responsible and informed, you can navigate the world of cryptocurrency and potentially reap its benefits while managing the risks. Remember, don’t invest more than you’re willing to lose and always prioritize your financial well-being.