Are you curious about the exciting world of machine learning for trading automation and efficiency? Well, buckle up and get ready to explore how technology is revolutionizing the way we trade in the financial markets!

Picture this: a powerful computer program that can analyze vast amounts of data, make predictions, and execute trades faster than you can blink. That’s the magic of machine learning in trading. It’s like having your own super-smart assistant that can navigate through the complexities of the stock market with ease.

So, how does it work? Machine learning algorithms are designed to learn from historical data and patterns, enabling them to predict future market movements. These algorithms can identify profitable trading opportunities, manage risks, and even automate the entire trading process. It’s like having a skilled trader working around the clock, using cutting-edge technology to maximize profits and minimize losses.

With machine learning for trading automation and efficiency, you can level up your trading game and stay ahead of the competition. So, let’s dive into the fascinating world of machine learning and discover how it can transform the way we trade!

Discover how machine learning can revolutionize trading by automating processes and enhancing efficiency. By leveraging advanced algorithms and data analysis, traders can make informed decisions and optimize their strategies. Machine learning algorithms can analyze vast amounts of historical data, identify patterns, and generate accurate predictions, leading to better trading outcomes. Embrace the power of machine learning to transform your trading practices and stay ahead of the competition.

Contents

- 1 Machine Learning for Trading Automation and Efficiency

- 2 Machine Learning Models for Trading Automation

- 3 Key Takeaways: Machine Learning for Trading Automation and Efficiency

- 4 Frequently Asked Questions

- 4.1 1. How can machine learning improve trading automation?

- 4.2 2. How can machine learning make trading more efficient?

- 4.3 3. Are there any challenges in implementing machine learning for trading automation?

- 4.4 4. Can machine learning replace human traders in the future?

- 4.5 5. What precautions should be taken when using machine learning for trading automation?

- 4.6 A machine learning approach to stock trading | Richard Craib and Lex Fridman

- 5 Summary

Machine Learning for Trading Automation and Efficiency

Welcome to this in-depth article on machine learning for trading automation and efficiency. In today’s rapidly changing financial landscape, traders and investors are constantly seeking ways to improve their strategies, increase efficiency, and gain a competitive edge. Machine learning, with its ability to analyze vast amounts of data and make data-driven predictions, has emerged as a powerful tool in the world of trading. In this article, we will explore the applications of machine learning in trading, its benefits, and tips on how to leverage it effectively.

Understanding Machine Learning in Trading

Machine learning refers to the use of algorithms and statistical models to enable computers to learn from data and make predictions or decisions without explicit programming. In the context of trading, machine learning can analyze massive amounts of market data, identify patterns, and make predictions about future market movements. This automated analysis saves time and reduces human error, allowing traders to make more informed decisions.

Machine learning algorithms can be used in various ways in trading. For example, they can be used to develop trading strategies, predict asset prices, optimize portfolio allocation, and automate trading execution. By analyzing historical data and identifying patterns, machine learning models can generate signals for buy or sell decisions, helping traders take advantage of market opportunities.

Moreover, machine learning can be used to analyze market sentiment by scraping news articles, social media data, and other unstructured data sources. By processing and analyzing these data, machine learning algorithms can extract valuable insights, sentiment scores, and relevant information that can impact market movements. These insights can give traders an edge in understanding market dynamics and making informed trading decisions.

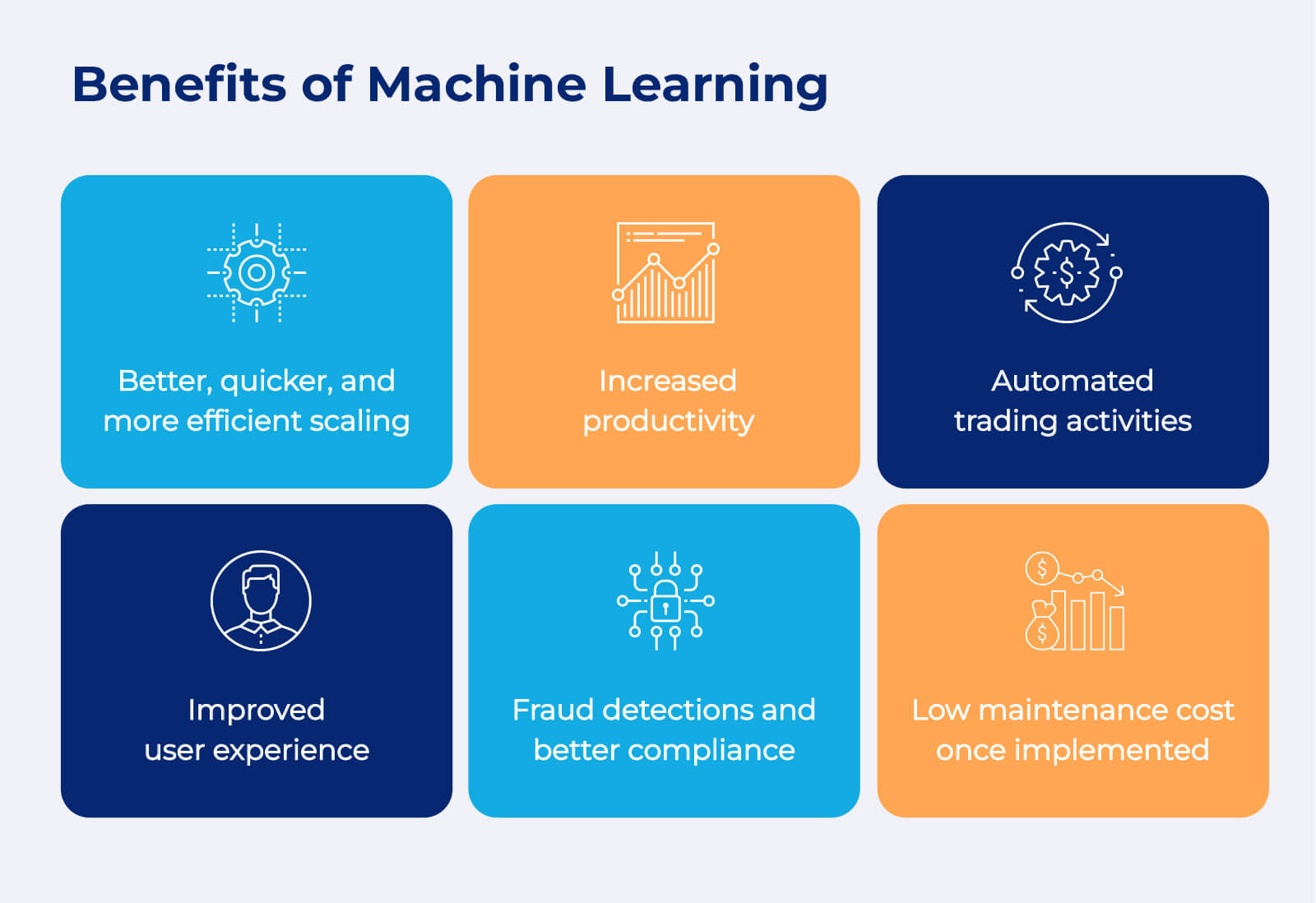

The Benefits of Machine Learning in Trading

Machine learning offers several benefits for trading automation and efficiency. One of the key advantages is the ability to analyze large volumes of data quickly and accurately. While it may take traders hours or even days to process and analyze data manually, machine learning algorithms can accomplish this task in a matter of seconds or minutes. This speed allows traders to make timely decisions based on real-time market data.

Another benefit of machine learning is its ability to detect patterns and anomalies in the data that may not be apparent to human traders. By identifying these patterns, machine learning models can make predictions about future market movements with higher accuracy. This can help traders spot profitable opportunities or avoid potential losses.

Furthermore, machine learning can automate repetitive tasks, such as data collection, data cleaning, and execution of trades. This automation frees up traders’ time, allowing them to focus on higher-level strategic decision-making and analysis. It also reduces human error, which can have a significant impact on trading outcomes.

Tips for Effective Machine Learning in Trading

While machine learning holds immense potential in trading, leveraging it effectively requires careful consideration and implementation. Here are some tips to make the most of machine learning for trading automation and efficiency:

1. Define Clear Goals:

Before embarking on a machine learning project, clearly define your goals and objectives. Determine what specific tasks or problems you want to solve using machine learning and establish measurable metrics to assess the success of your models.

2. Gather Quality Data:

The quality of data used to train machine learning models is crucial. Ensure that you have access to accurate and reliable data from reputable sources. Clean the data by removing outliers, inconsistencies, and missing values to ensure optimal model performance.

3. Select the Right Algorithms:

There is a wide range of machine learning algorithms available, each suited for different types of problems. Understand the strengths and weaknesses of different algorithms and choose the ones that align with your goals and dataset.

4. Continuously Refine and Update Models:

Machine learning models need to adapt to changing market conditions. Regularly monitor and evaluate the performance of your models and update them as needed. Consider implementing techniques like reinforcement learning or ensemble methods to enhance model accuracy.

5. Interpret and Validate Results:

While machine learning models can provide valuable insights and predictions, it is essential to interpret and validate their results. Understand the limitations of the models and cross-validate their performance using different validation techniques to ensure robustness.

6. Stay Abreast of Regulatory and Ethical Considerations:

Machine learning in trading raises various ethical and regulatory considerations. Stay updated with the latest regulations and ensure that your models adhere to ethical standards. Be mindful of potential biases in the data and algorithms that can lead to harmful decisions.

By following these tips, traders can harness the power of machine learning to automate processes, improve efficiency, and make more informed trading decisions.

Machine Learning Models for Trading Automation

When it comes to machine learning for trading automation, various models can be employed depending on the specific trading task. Let’s explore some commonly used machine learning models:

Support Vector Machines (SVM)

Support Vector Machines (SVM) are powerful algorithms used for classification and regression tasks. In trading, SVM can be used to classify market conditions as bullish or bearish based on historical price data, technical indicators, and other relevant features. Traders can then use these classifications to make buy or sell decisions.

One of the key advantages of SVM is its ability to handle high-dimensional data efficiently. This makes it suitable for analyzing complex market data and extracting meaningful patterns that can guide trading decisions. SVM can also handle non-linear relationships between variables, allowing it to capture complex market dynamics.

However, SVM models require careful tuning of hyperparameters and feature selection to achieve optimal performance. Additionally, SVM models can be computationally expensive, especially when dealing with large datasets. Overall, SVM is a versatile machine learning model that can be effective for trading automation.

Recurrent Neural Networks (RNN)

Recurrent Neural Networks (RNN) are a type of deep learning algorithm widely used in sequential data analysis. In trading, RNN can be used to analyze time-series data, such as stock prices, and make predictions about future price movements.

RNN models have an inherent ability to capture temporal dependencies in data, making them suitable for time-series analysis. They can learn from past price patterns and use this knowledge to predict future price trends. By incorporating feedback loops in the network architecture, RNN models can also capture long-term dependencies, making them effective in predicting long-term price trends.

However, RNN models can suffer from the vanishing gradient problem, where the gradients required for updating the model parameters diminish over time. This can limit their ability to capture long-term dependencies accurately. Techniques like Long Short-Term Memory (LSTM) networks or Gated Recurrent Units (GRU) can address this issue and enhance the performance of RNN models in trading applications.

Random Forests

Random Forests is an ensemble learning method that combines multiple decision trees to make predictions. In trading, Random Forests can be used for classification tasks, such as predicting whether a stock will rise or fall based on various features and market conditions.

The main advantage of Random Forests is their ability to handle large and complex datasets. They can handle high-dimensional feature spaces efficiently and are less prone to overfitting compared to individual decision trees. Random Forests can also provide measures of feature importance, allowing traders to identify the most relevant factors influencing their trading decisions.

However, Random Forests can be computationally demanding and may not scale well to massive datasets. They can also struggle with imbalanced datasets, where one class dominates the others, leading to biased predictions. Careful consideration of data preprocessing techniques and parameter tuning is essential to maximize the performance of Random Forests models in trading scenarios.

In conclusion, machine learning offers immense potential for trading automation and efficiency. By understanding the different machine learning models and applying them effectively, traders can leverage data-driven insights to optimize their trading strategies and gain a competitive edge.

Key Takeaways: Machine Learning for Trading Automation and Efficiency

- Machine learning can help automate trading strategies.

- It improves efficiency by analyzing large amounts of data quickly.

- Using machine learning can reduce human error in trading decisions.

- It allows for more accurate predictions based on historical data.

- Implementing machine learning for trading requires proper data preprocessing and model training.

Frequently Asked Questions

When it comes to machine learning for trading automation and efficiency, many people have questions. Here are some common queries and their answers:

1. How can machine learning improve trading automation?

Machine learning plays a crucial role in enhancing trading automation. By analyzing vast amounts of historical data, machine learning algorithms can identify patterns, trends, and correlations that humans might miss. This enables automated trading systems to make more informed decisions in real-time. Machine learning models can adapt and learn from data, continually improving their performance and accuracy over time. This can lead to more efficient execution of trades and reduced human intervention.

Moreover, machine learning can also contribute to improving risk management in trading. By analyzing market data, news sentiment, and other relevant factors, machine learning models can identify potential risks and vulnerabilities. This can help trading systems in implementing more effective risk mitigation strategies, minimizing losses, and maximizing returns.

2. How can machine learning make trading more efficient?

Machine learning can enhance trading efficiency in various ways. One key aspect is the ability to automate repetitive and time-consuming tasks. By employing machine learning algorithms, traders can automate processes such as data collection, interpretation, and analysis. This frees up time for traders to focus on higher-level strategic decisions and reduces the chances of human error.

Furthermore, machine learning can assist in optimizing trading strategies. By analyzing historical data, machine learning models can identify patterns and trends that indicate profitable trading opportunities. These models can then generate trading signals or recommend optimal trade execution strategies. Additionally, machine learning algorithms can analyze vast amounts of data in real-time, enabling traders to react swiftly to market changes and take advantage of time-sensitive opportunities.

3. Are there any challenges in implementing machine learning for trading automation?

Implementing machine learning for trading automation does come with certain challenges. One of the main hurdles is the availability and quality of data. Machine learning models require vast amounts of historical data to train effectively. Acquiring relevant, clean, and reliable data can be a complex task.

Another challenge is the complexity of developing and maintaining machine learning models. Building robust and accurate models requires expertise in data science and machine learning techniques. Additionally, models need regular monitoring and updating to ensure they adapt to changing market conditions and remain reliable.

4. Can machine learning replace human traders in the future?

While machine learning can greatly enhance trading automation, it is unlikely to completely replace human traders in the near future. Human intuition, creativity, and the ability to interpret complex market dynamics still hold great value in trading. Machine learning algorithms excel at processing vast amounts of data and identifying patterns, but they lack the human touch in understanding external factors such as geopolitical events or market sentiment.

However, the role of human traders might evolve as machine learning continues to advance. Traders who embrace machine learning can leverage its capabilities to make more informed decisions, manage risks better, and optimize their strategies. The collaboration between humans and machines is likely to be the winning formula in trading.

5. What precautions should be taken when using machine learning for trading automation?

When implementing machine learning for trading automation, it’s essential to exercise caution and apply risk management practices. Machine learning models are developed based on historical data, and they may not always account for unexpected events or market anomalies.

To mitigate risks, it’s crucial to thoroughly backtest and validate machine learning models using out-of-sample testing. This helps ensure the models perform well in scenarios they haven’t been specifically trained on. Additionally, having human oversight and intervention is crucial to monitor system performance and intervene when necessary. Regular monitoring, model updates, and continuous improvement are vital to maintain the efficiency and effectiveness of machine learning-based trading systems.

A machine learning approach to stock trading | Richard Craib and Lex Fridman

Summary

Machine learning can help make trading faster and more efficient. It uses algorithms to analyze data and make predictions about the stock market. This can reduce the amount of time and effort needed for trading decisions.

By automating trading strategies, machine learning can remove human emotions and biases. It can also adapt to changing market conditions and make adjustments accordingly. This can lead to better investment decisions and potentially higher profits.

However, it’s important to note that machine learning is not a guaranteed way to make money. It requires careful analysis and constant monitoring. Overall, machine learning can be a powerful tool for traders to improve their efficiency and profitability.