Welcome to the world of DeFi! In this deep dive, we’re going to explore the exciting realm of yield farming and show you how to become a Master of DeFi. Sounds intriguing, right?

But hold on a second, what exactly is yield farming? Well, buckle up because we’re about to find out. Yield farming is a way to put your crypto assets to work and earn a passive income by participating in various decentralized finance protocols. It’s like putting your money into a high-yield savings account, but with a DeFi twist.

Now, you might be wondering how you can become a Master of DeFi and navigate the intricacies of yield farming. Don’t worry, we’re here to guide you every step of the way. From understanding different farming strategies to choosing the right platforms and managing risk, we’ve got you covered. Get ready to dive into the fascinating world of DeFi and unlock the potential of yield farming!

Contents

- 1 Mastering DeFi: A Deep Dive into Yield Farming

- 2 An Introduction to Yield Farming

- 3 Understanding Liquidity Pools

- 4 Different Yield Farming Strategies

- 5 Yield Farming Risks and Considerations

- 6 Yield Farming vs. Traditional Finance

- 7 Tips for Successful Yield Farming

- 8 The Future of Yield Farming

- 9 Key Takeaways: Mastering DeFi: A Deep Dive into Yield Farming

- 10 Frequently Asked Questions

- 10.1 1. How does yield farming work?

- 10.2 2. What are the risks of yield farming?

- 10.3 3. How do I choose the right platform for yield farming?

- 10.4 4. What are the different strategies in yield farming?

- 10.5 5. How can I mitigate the risks of yield farming?

- 10.6 5 Crazy Passive Income Strategies In DeFi (Yield Farming)

- 11 Summary

Mastering DeFi: A Deep Dive into Yield Farming

Welcome to the world of decentralized finance (DeFi), where traditional financial systems meet the power of blockchain technology. In this article, we will take a comprehensive look at yield farming, one of the most exciting and potentially lucrative aspects of DeFi. Get ready to explore the ins and outs of yield farming, learn the strategies to maximize your earnings, and discover the risks and rewards that come with this innovative form of investment.

An Introduction to Yield Farming

Yield farming, also known as liquidity mining, is the practice of staking or lending cryptocurrencies to earn rewards or interest. It involves leveraging various decentralized finance protocols to generate passive income by providing liquidity to these platforms. Yield farmers allocate their crypto assets to liquidity pools, where they can be used by borrowers in exchange for earning rewards in the form of additional tokens.

The concept of yield farming emerged as a way to incentivize users to provide liquidity to decentralized exchanges and lending platforms. By staking their assets, users contribute to the liquidity of these platforms, enabling efficient and seamless trading for other participants. In return, they earn a share of the transaction fees or receive additional tokens as rewards.

Yield farming has garnered significant attention due to the potential for high returns, often surpassing traditional banking interest rates. However, it is essential to understand the risks, rewards, and strategies involved to navigate this complex ecosystem effectively.

Understanding Liquidity Pools

When diving into the world of yield farming, it is vital to familiarize yourself with the concept of liquidity pools. Liquidity pools are decentralized finance protocols that allow users to pool their assets together, creating a liquidity pool that can be utilized for various purposes, such as trading or lending.

By contributing to a liquidity pool, users enable others to trade or borrow assets more easily, as there is always a sufficient supply available. In exchange for providing liquidity, users earn tokens known as LP (Liquidity Provider) tokens. These LP tokens represent the user’s share in the liquidity pool and can be redeemed for the underlying crypto assets at any time. The value of LP tokens may fluctuate based on the demand for the liquidity pool and changes in market conditions.

It is important to note that yield farming requires careful consideration of the risks and rewards associated with each liquidity pool. Factors such as the platform’s reputation, the performance of the underlying assets, and the overall market conditions must be taken into account before choosing a liquidity pool to farm yields.

Different Yield Farming Strategies

Now that we have a basic understanding of yield farming and liquidity pools, let’s explore some popular strategies that yield farmers employ to maximize their returns. It is essential to note that these strategies are dynamic and can vary depending on the market conditions and specific platforms.

1. Single-Token Farming

In single-token farming, yield farmers stake a single token in a liquidity pool to earn additional rewards. For example, if you hold Ethereum, you can deposit it into a liquidity pool and receive additional Ethereum-based tokens as rewards. This strategy is relatively straightforward and involves minimal exposure to the risks of impermanent loss, as the farmer only holds a single asset.

However, it is crucial to evaluate the potential rewards, tokenomics, and risks associated with the specific token being farmed. Analyzing the project’s fundamentals and market demand for the token can help inform your decision-making process.

Single-token farming is often a good starting point for newcomers to yield farming, as it allows them to familiarize themselves with the process and gauge their risk tolerance before exploring more complex strategies.

2. Dual-Token Farming

Dual-token farming involves staking two different tokens within a liquidity pool to earn rewards. This strategy is commonly used when yield farmers believe that the value of one token will outperform the other in the long run. By staking a pair of assets, farmers can earn rewards in both tokens, effectively boosting their overall gains.

When engaging in dual-token farming, it is important to carefully select the token pairs based on their underlying fundamentals, market conditions, and the potential for price appreciation. Conducting thorough research, reading project whitepapers, and consulting with experienced yield farmers can help you make informed decisions.

Dual-token farming comes with increased complexity and risk compared to single-token farming, as it involves exposure to two different assets. Therefore, it is crucial to diversify your portfolio, manage risks effectively, and be prepared for potential losses in one token outweighing gains in the other.

3. Stablecoin Farming

Stablecoin farming involves liquidity provision using stablecoins, such as USDT, USDC, or DAI. Stablecoins are cryptocurrencies pegged to the value of a specific fiat currency, providing stability in the volatile crypto market. Yield farmers often consider stablecoin farming as a lower-risk option due to the reduced price volatility compared to other cryptocurrencies.

By staking stablecoins in liquidity pools, farmers can earn both stablecoin rewards and potentially higher yields in other tokens. The stable nature of stablecoins makes them an attractive option for risk-averse investors looking to earn a steady income without exposure to the price fluctuations typically associated with cryptocurrencies.

However, it is important to evaluate the risks associated with the specific stablecoin being used, the stability and credibility of the platform, and the potential impact of market conditions on the value of stablecoins.

4. Risk Mitigation Strategies

While yield farming offers the potential for high returns, it also comes with inherent risks. To mitigate these risks, experienced yield farmers employ various strategies:

- Diversification: Spreading investments across multiple liquidity pools and tokens reduces the impact of any single pool’s failure or token’s decline in value.

- Research: Conduct thorough due diligence on the projects, teams, and underlying tokenomics before investing in a liquidity pool.

- Rebalancing: Regularly reassess and adjust your portfolio to maintain optimal risk-reward ratios.

- Exit Strategies: Set exit points and take profits along the way to protect your investments and minimize potential losses.

Remember, yield farming is a dynamic and evolving field, and it is essential to stay updated with the latest trends, news, and developments to ensure informed decision-making.

Yield Farming Risks and Considerations

While yield farming offers the potential for substantial returns, it is crucial to understand the risks involved. The decentralized nature of DeFi introduces unique challenges and vulnerabilities that can lead to potential losses:

1. Impermanent Loss

Impermanent loss occurs when the value of the staked crypto assets in a liquidity pool deviates significantly from their value held outside the pool. This deviation can happen due to intense price volatility or price disparities between the assets in the pool. Yield farmers often face impermanent loss when the price of one token in a pool significantly outperforms or underperforms the other token.

Understanding impermanent loss requires a deep understanding of the token pair dynamics, market conditions, and price volatility. It is crucial to analyze the historical performance and potential fluctuations of the paired tokens before committing your assets to a liquidity pool.

To mitigate impermanent loss, some yield farmers implement strategies such as utilizing oracle-backed stablecoins, selecting stablecoin pairs, or actively managing their positions in response to market movements.

2. Smart Contract Risks

Decentralized finance relies heavily on smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. While smart contracts offer transparency and remove the need for intermediaries, they also come with inherent risks.

Smart contracts are vulnerable to coding bugs or malicious attacks that can lead to the loss or theft of funds. It is crucial to thoroughly review the code and audit reports of the protocols and platforms you intend to use for yield farming. Conducting due diligence on the development teams and their track record can provide additional assurance of the code’s integrity.

Furthermore, it is recommended to start with smaller investments and gradually increase your exposure as you gain confidence in the platform’s security and reliability.

3. Regulatory Uncertainty

As the decentralized finance space continues to grow and disrupt traditional financial systems, regulatory frameworks are still catching up. The lack of comprehensive regulations surrounding DeFi exposes participants to uncertainties and potential legal implications.

It is essential to stay updated on the regulatory landscape of your jurisdiction and understand the potential consequences of participating in decentralized finance activities. Consulting with legal and financial professionals can provide valuable guidance and ensure compliance with applicable laws.

Remember, the information presented in this article is for educational purposes only and should not be considered financial or investment advice. Always conduct thorough research and consult with professionals before making any investment decisions.

Yield Farming vs. Traditional Finance

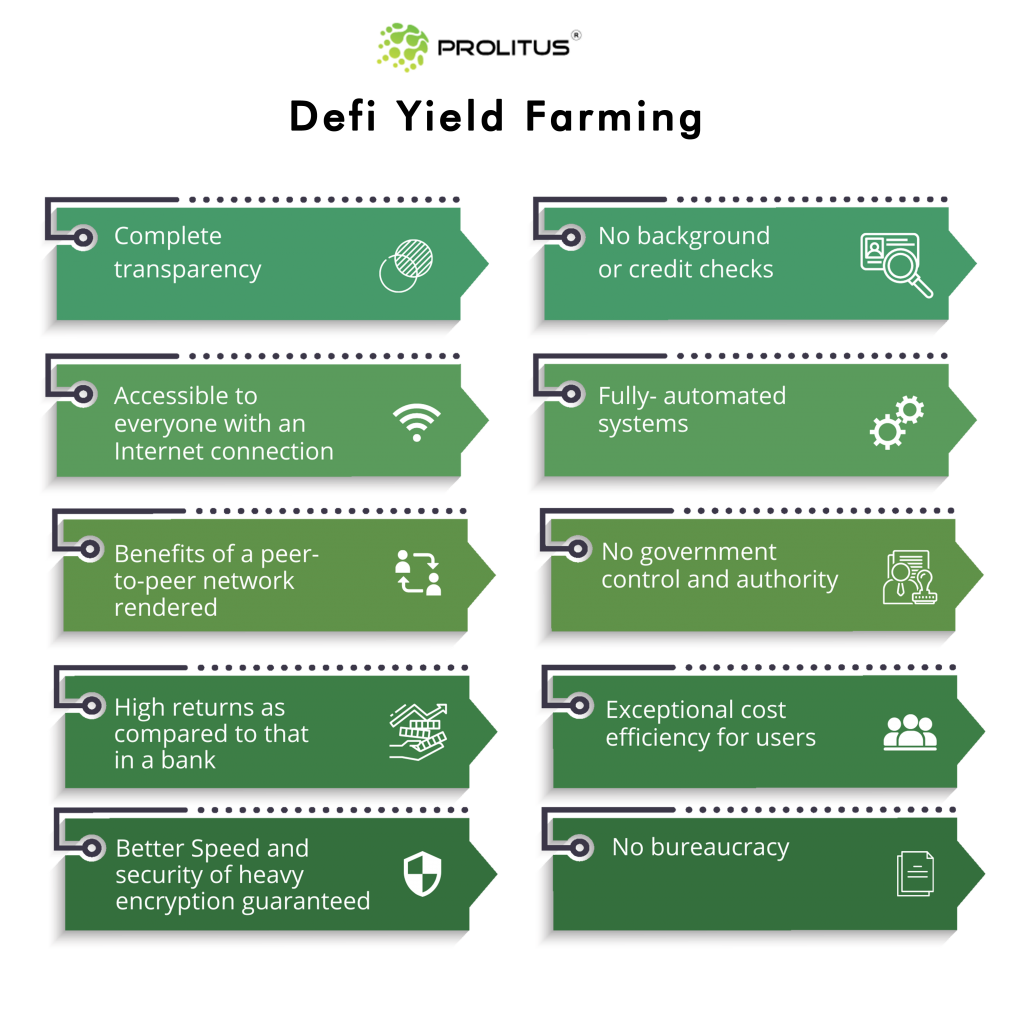

Yield farming in decentralized finance introduces several key differences when compared to traditional financial systems. Let’s explore some of the advantages and considerations that distinguish yield farming from traditional finance:

1. Access and Inclusion

Yield farming eliminates many barriers associated with traditional finance, such as credit checks, minimum investment requirements, or geographical restrictions. Decentralized finance platforms are open to anyone with an internet connection, allowing individuals from around the world to participate and earn passive income.

2. Transparency and Trustlessness

Decentralized finance operates on public blockchains, offering transparency and immutability. Smart contracts, auditable code, and transparent transactions provide participants with a high level of trust in the platforms and protocols they use for yield farming.

3. Potential for Higher Returns

Yield farming can offer significantly higher returns compared to traditional banking or investment products. By leveraging DeFi protocols, yield farmers can access enhanced interest rates and participate in lucrative reward programs, potentially outperforming traditional financial instruments.

4. Risks and Volatility

While yield farming offers the potential for higher returns, it also exposes participants to increased risks and market volatility. The decentralized and dynamic nature of DeFi platforms demands a thorough understanding of the associated risks and the implementation of risk management strategies.

5. Regulation and Security

Traditional financial systems benefit from established regulatory frameworks and security measures. In contrast, the decentralized nature of DeFi introduces regulatory uncertainties and inherent risks associated with smart contract vulnerabilities. Participants must carefully evaluate the security measures and regulatory compliance of the platforms they engage with.

Tips for Successful Yield Farming

Yield farming can be a lucrative endeavor if approached with careful consideration and strategic planning. Here are some tips to help you get started on your path to successful yield farming:

1. Educate Yourself

Take the time to understand the fundamental concepts of decentralized finance, liquidity pools, and yield farming. Familiarize yourself with different strategies, risks, and industry trends. Stay updated with the latest developments through online communities, forums, and reputable educational resources.

2. Start Small

As with any investment, it is prudent to start with a small portfolio and gradually increase your exposure as you gain experience and confidence in your chosen platforms. This allows you to learn from any mistakes or setbacks without risking substantial losses.

3. Conduct Thorough Research

Prioritize thorough research before committing your assets to a liquidity pool or platform. Understand the project’s background, the team behind it, and the tokenomics of the assets involved. Keep an eye on the community sentiment and the platform’s reputation within the decentralized finance ecosystem.

4. Diversify Your Portfolio

Spreading your investments across multiple liquidity pools and tokens is a sound risk management strategy. Diversification reduces the impact of any single pool’s failure or token’s price decline. Consider selecting pools with different risk profiles and complementary assets.

5. Stay Informed

Yield farming is a rapidly evolving field, with new protocols and opportunities emerging regularly. Stay informed about the latest trends, innovations, and security considerations. Engage with the decentralized finance community, join online forums, and collaborate with experienced yield farmers to stay ahead of the curve.

The Future of Yield Farming

Yield farming represents an innovative and dynamic aspect of decentralized finance, where participants can leverage blockchain technology to earn passive income and shape the future of finance. As the decentralized finance ecosystem continues to expand and mature, yield farming is likely to become more accessible and refined.

Expect to see advancements in risk management strategies, enhanced security measures, and increased regulatory clarity surrounding the DeFi space. With growing interest from both retail and institutional investors, the potential rewards and opportunities in yield farming are likely to become even greater.

Remember, always approach yield farming with caution, conduct thorough research, and remain vigilant about the risks involved. With the right knowledge, strategies, and risk management practices, you can master the art of yield farming and unlock its full potential.

Key Takeaways: Mastering DeFi: A Deep Dive into Yield Farming

- Yield farming is a way to earn passive income by lending or staking cryptocurrencies.

- It involves participating in DeFi protocols to maximize returns on your invested assets.

- Researching and understanding the risks associated with different projects and protocols is crucial in yield farming.

- Balancing your portfolio to diversify your investments can help mitigate potential losses in yield farming.

- Continuously monitoring the market and adjusting your strategies is essential to stay profitable in yield farming.

Frequently Asked Questions

Are you ready to dive into the exciting world of DeFi and yield farming? Here are some commonly asked questions to help you master the art of earning yields in the decentralized finance ecosystem.

1. How does yield farming work?

Yield farming is a way to earn passive income by lending or staking cryptocurrencies on decentralized platforms. It involves providing liquidity to liquidity pools and earning interest, fees, or new tokens as rewards. By locking your assets in these pools, you contribute to the liquidity of the platform and earn a portion of the platform’s profits.

Yield farmers typically choose a platform, deposit their crypto assets into a liquidity pool, and receive LP tokens in return. These LP tokens represent their share of the pool, and they can use them to claim rewards proportionate to their contribution. The reward may come in various forms, such as additional tokens or a percentage of transaction fees.

2. What are the risks of yield farming?

While yield farming can be profitable, it also comes with its risks. One of the major risks is impermanent loss, which occurs when the value of the assets you provide as liquidity changes compared to the value of those assets when you first deposited them. If the price of one asset in the pool drastically increases or decreases, you may end up with less value than if you had simply held onto your assets.

Smart contract risks are also a concern in yield farming. Since yield farming relies on smart contracts to execute transactions and distribute rewards, any vulnerabilities in these contracts can lead to potential hacks or exploits. It’s important to thoroughly research and choose well-audited platforms to mitigate this risk. Moreover, the volatility and unpredictability of the crypto market can also impact the profitability of yield farming strategies.

3. How do I choose the right platform for yield farming?

When selecting a platform for yield farming, it’s crucial to consider several factors. First, ensure that the platform has a strong reputation and is well-audited for security. Look for platforms that have implemented measures to protect user funds and have a transparent governance system.

Additionally, compare the APY (Annual Percentage Yield) rates offered by different platforms. Higher APY does not always mean better returns, as it could be accompanied by higher risks or excessive token inflation. Evaluate the tokenomics of the platform and assess factors such as token supply, circulating supply, and token utility to determine its long-term potential.

4. What are the different strategies in yield farming?

Yield farming offers various strategies to maximize your earnings. One popular strategy is known as “liquidity mining,” where you provide liquidity to pools that offer rewards in a project’s native tokens. Another strategy involves “yield optimizing,” where you move your funds between different platforms to chase higher yields.

Additionally, you can explore “stablecoin farming” by providing liquidity to pairs involving stablecoins to earn relatively stable yields. Another strategy is “arbitrage farming,” where you take advantage of price differences between different platforms or exchanges to generate profits. Each strategy has its own risk-reward profile, and it’s important to research and understand them before diving in.

5. How can I mitigate the risks of yield farming?

While it’s impossible to eliminate all risks, there are steps you can take to mitigate them. Diversification is key – spread your investments across multiple platforms and projects to reduce the impact of potential losses. Conduct thorough research on the platforms you’re considering, and don’t hesitate to reach out to the community or experts for advice.

Stay updated on the latest news and developments in the DeFi space. Be aware of any security audits, protocol changes, or potential red flags within the platforms you’re farming on. Finally, start with a small investment and gradually increase as you gain experience and confidence in the platforms and strategies you choose.

5 Crazy Passive Income Strategies In DeFi (Yield Farming)

Summary

Yield farming in DeFi is like planting seeds to grow your money. It involves lending or staking your cryptocurrencies to earn more tokens as rewards. Just be mindful of the risks, like smart contract vulnerabilities and market volatility.

To become a successful yield farmer, start by researching different platforms and their yield farming opportunities. Next, choose the right assets to invest in, and diversify your portfolio for stability. It’s important to keep track of your investments and stay informed about any updates or changes in the market.

Remember, yield farming can provide exciting opportunities to earn passive income, but it’s crucial to do your due diligence and understand the risks involved. Stay curious, keep learning, and take small steps to master the world of DeFi. Happy farming!