In today’s digital world, cryptocurrencies have become the talk of the town. But, is crypto a good investment? Let’s dive in and find out!

Cryptocurrencies, like Bitcoin and Ethereum, have gained significant attention in recent years. People are intrigued by their potential to generate substantial returns and revolutionize the financial landscape. But, should you jump on the crypto bandwagon?

Well, it’s important to understand that investing in crypto comes with risks and rewards. While some investors have made fortunes, others have experienced significant losses. So, before you decide to invest, it’s crucial to evaluate your risk tolerance and do thorough research.

When it comes to crypto, there’s no one-size-fits-all answer. It can be a thrilling investment opportunity, but it’s essential to approach it with caution, knowledge, and a long-term perspective. So, let’s explore the world of crypto, unravel its mysteries, and make an informed decision about whether it’s a good investment or not!

Contents

- 1 Is Crypto a Good Investment?

- 2 The Rise of Cryptocurrency

- 3 Key Takeaways: Is Crypto a Good Investment?

- 4 Frequently Asked Questions

- 4.1 1. What factors should I consider before investing in cryptocurrency?

- 4.2 2. Can cryptocurrency be a good long-term investment?

- 4.3 3. What are the risks associated with investing in cryptocurrency?

- 4.4 4. How can I store my cryptocurrency securely?

- 4.5 5. Should I invest in Bitcoin or other cryptocurrencies?

- 4.6 Revealed: The BEST Time To Buy & Sell Crypto for MAXIMUM Profit 💰💰💰

- 5 Summary:

Is Investing in Cryptocurrency a Smart Choice?

With the increasing popularity of cryptocurrency, many wonder if it’s a good investment. While it offers potential for high returns, there are risks to consider. One key advantage is its decentralized nature, providing security and privacy. Additionally, cryptocurrencies can be easily traded and accessed globally. However, the volatile market can lead to significant price fluctuations. It’s important to research and diversify your investments, only committing funds you can afford to lose. Overall, crypto can be a good investment option, but careful consideration is crucial.

Is Crypto a Good Investment?

Cryptocurrency has taken the financial world by storm, with Bitcoin being the most well-known example. But is crypto a good investment? With its volatile nature and uncertain future, it’s important to understand the potential risks and rewards before diving in. In this article, we will explore the intricacies of investing in cryptocurrencies and provide you with valuable insights to make an informed decision.

The Rise of Cryptocurrency

Cryptocurrency has emerged as a disruptive force in the financial industry. It is a digital or virtual form of currency that uses cryptography for security. The first cryptocurrency, Bitcoin, was introduced in 2009 and has since gained widespread popularity. Its meteoric rise in value sparked the interest of investors, leading to the creation of numerous other cryptocurrencies like Ethereum, Litecoin, and Ripple.

The Potential Benefits of Investing in Crypto

Investing in cryptocurrency can offer several potential benefits. Firstly, many cryptocurrencies have experienced significant growth in value over the years. Bitcoin, for example, has seen tremendous returns on investment for early adopters. This potential for high returns has attracted the attention of many investors looking to diversify their portfolios.

Secondly, cryptocurrencies provide an opportunity for borderless transactions. Traditionally, transferring money across borders can be expensive and time-consuming. With cryptocurrency, transactions can be completed quickly and with lower fees. This can be especially beneficial for businesses operating globally or individuals sending remittances to their families in different countries.

Additionally, cryptocurrencies can offer a level of anonymity and security. Transacting with crypto can provide users with the option to remain pseudonymous, protecting their identity. Blockchain technology, which underlies most cryptocurrencies, also ensures the transparency and security of transactions, reducing the risk of fraud or tampering.

The Risks and Challenges of Cryptocurrency Investment

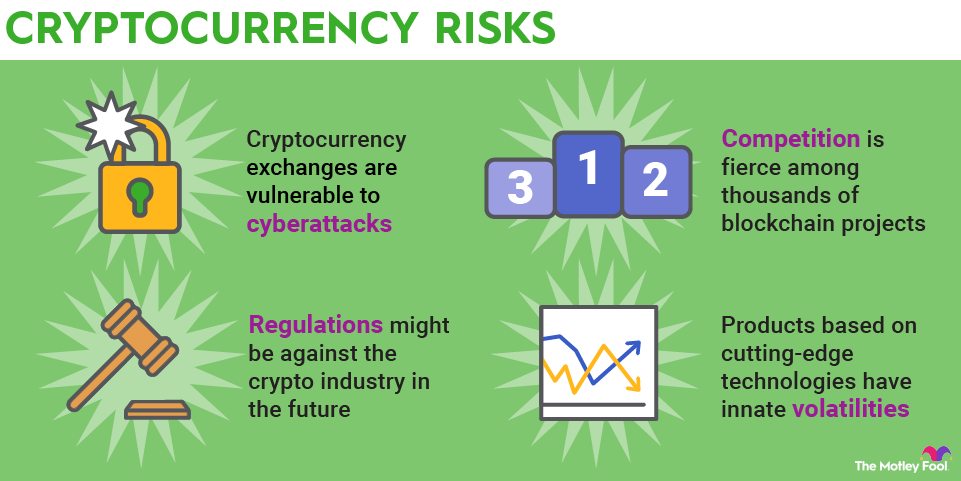

While the potential benefits of investing in cryptocurrency are enticing, it’s important to consider the risks and challenges as well. Firstly, the cryptocurrency market is highly volatile. Prices can fluctuate dramatically within a short period, making it a risky investment. It requires a strong risk appetite and the willingness to tolerate potential losses.

The lack of regulation and oversight is another concern. Unlike traditional financial markets, cryptocurrencies operate in a relatively unregulated environment. This lack of regulation can expose investors to scams, fraudulent schemes, and hacks. It’s crucial to carefully research and choose reputable cryptocurrency exchanges and ensure proper security measures are in place to safeguard your investments.

Furthermore, cryptocurrencies face uncertainty in terms of their long-term viability and acceptance. Governments and financial institutions worldwide have taken varied stances on cryptocurrencies, which can impact their future value and adoption. It’s important to stay informed about regulatory developments and industry trends to make informed investment decisions.

Key Takeaways: Is Crypto a Good Investment?

- Crypto investments can be risky and volatile, so it’s important to do thorough research before investing.

- Investing in crypto can offer high returns, but it’s important to consider the potential for loss as well.

- Diversifying your investment portfolio is crucial to minimize risk in the crypto market.

- Keeping up with crypto news and trends can help you make informed investment decisions.

- It’s advisable to start with a small investment and gradually increase as you gain knowledge and experience.

Frequently Asked Questions

Are you considering investing in cryptocurrency but unsure if it’s a good investment? Here are some common questions to help you navigate the world of crypto investments.

1. What factors should I consider before investing in cryptocurrency?

Before investing in cryptocurrency, it’s important to consider a few key factors. Firstly, research the technology behind the cryptocurrency and its potential real-world application. Look into its market capitalization and trading volume to gauge its popularity and liquidity. Additionally, carefully assess any associated risks such as market volatility and regulatory factors. It’s crucial to have a clear understanding of the potential rewards and risks before making an investment decision.

Secondly, evaluate your personal financial situation and risk tolerance. Determine the amount of money you’re willing to invest and potentially lose. Cryptocurrency investments can be highly unpredictable, so it’s essential to invest only what you can afford to lose. Finally, consider seeking advice from financial professionals or industry experts who can provide insights and guidance tailored to your specific investment goals and risk profile.

2. Can cryptocurrency be a good long-term investment?

While the cryptocurrency market can be highly volatile, it does offer potential long-term investment opportunities. Some proponents believe that cryptocurrencies have the potential to revolutionize industries and become widely adopted in the future, leading to significant returns for early investors. Bitcoin, for example, has experienced substantial growth since its inception.

However, it’s important to approach long-term cryptocurrency investment with caution. Due to the unpredictable nature of the market, diversifying your investment portfolio is advisable to mitigate risk. Only allocate a portion of your investment funds to cryptocurrencies and consider investing in more established assets as well. Ongoing research, staying informed about market trends, and regular portfolio evaluation are crucial for long-term crypto investment success.

3. What are the risks associated with investing in cryptocurrency?

Investing in cryptocurrency carries inherent risks that potential investors should be aware of. The most significant risk is market volatility. Cryptocurrency prices can fluctuate wildly in a short period, leading to substantial gains or losses. Lack of regulation and limited investor protection also pose risks, as fraudulent activities and market manipulation are possible.

Additionally, there is a cybersecurity risk associated with holding cryptocurrencies. Hackers can target cryptocurrency exchanges or individual wallets, potentially leading to the loss of funds. It’s important to use reputable exchanges and secure storage methods, such as hardware wallets, to minimize this risk. Finally, there is a risk of investing in an unsuccessful or fraudulent cryptocurrency project. Thorough research and due diligence are key to mitigate these risks.

4. How can I store my cryptocurrency securely?

Securing your cryptocurrency is crucial to protect your investment. There are several methods to store your crypto securely. One popular option is using hardware wallets, which are physical devices that store your private keys offline and away from potential cyber threats. These devices provide an extra layer of security and are highly recommended for long-term storage.

Another option is using software wallets, which are applications that can be installed on your computer or mobile device. Software wallets come in different forms – some are connected to the internet, while others are offline. For small amounts of cryptocurrency or frequent transactions, online wallets can be convenient, but they come with higher security risks. Offline software wallets, also known as cold wallets, offer increased security but can be less convenient for regular use.

5. Should I invest in Bitcoin or other cryptocurrencies?

Deciding whether to invest in Bitcoin or other cryptocurrencies depends on your investment goals and risk tolerance. Bitcoin is the most well-known cryptocurrency with the largest market capitalization, making it a relatively safer choice compared to other cryptocurrencies. It has established itself as a store of value and is considered the digital gold by many investors.

However, other cryptocurrencies, often referred to as altcoins, have the potential for higher growth but also come with increased risks. These altcoins may offer innovative features or target specific industries, which could lead to significant returns if successful. It’s important to conduct thorough research and assess the potential risks and rewards before investing in any cryptocurrency, including Bitcoin.

Revealed: The BEST Time To Buy & Sell Crypto for MAXIMUM Profit 💰💰💰

Summary:

So, is crypto a good investment? Well, it’s risky because its value can change a lot. It’s important to do research and only invest money you can afford to lose. Remember, there are no guarantees and it’s important to be cautious.

However, some people believe in the potential of crypto and have made money from it. It’s important to understand the risks and benefits before making any decisions. In the end, it’s up to you to decide if crypto is right for you. Just remember to be careful and make informed choices!