Cryptocurrencies like Bitcoin and Ethereum have taken the world by storm, offering exciting investment opportunities. But what happens when you experience losses in the crypto market? That’s where claiming crypto losses on taxes comes into play! In this article, we’ll walk you through the steps on how to do just that.

When it comes to taxes, it’s essential to understand how to navigate the world of crypto losses. Don’t worry, though; it’s not as complicated as it sounds. We’ll break it down for you in simple terms, so you can confidently report your losses on your tax return.

Navigating the world of taxes may seem daunting, but fear not! We’re here to guide you through the process of claiming crypto losses on your taxes. By the end of this article, you’ll have a clear understanding of how to report your losses and potentially offset your taxable income. So let’s dive in and make taxes a little less intimidating!

1. Gather all documentation related to your crypto investments and losses.

2. Determine the cost basis and fair market value for each investment.

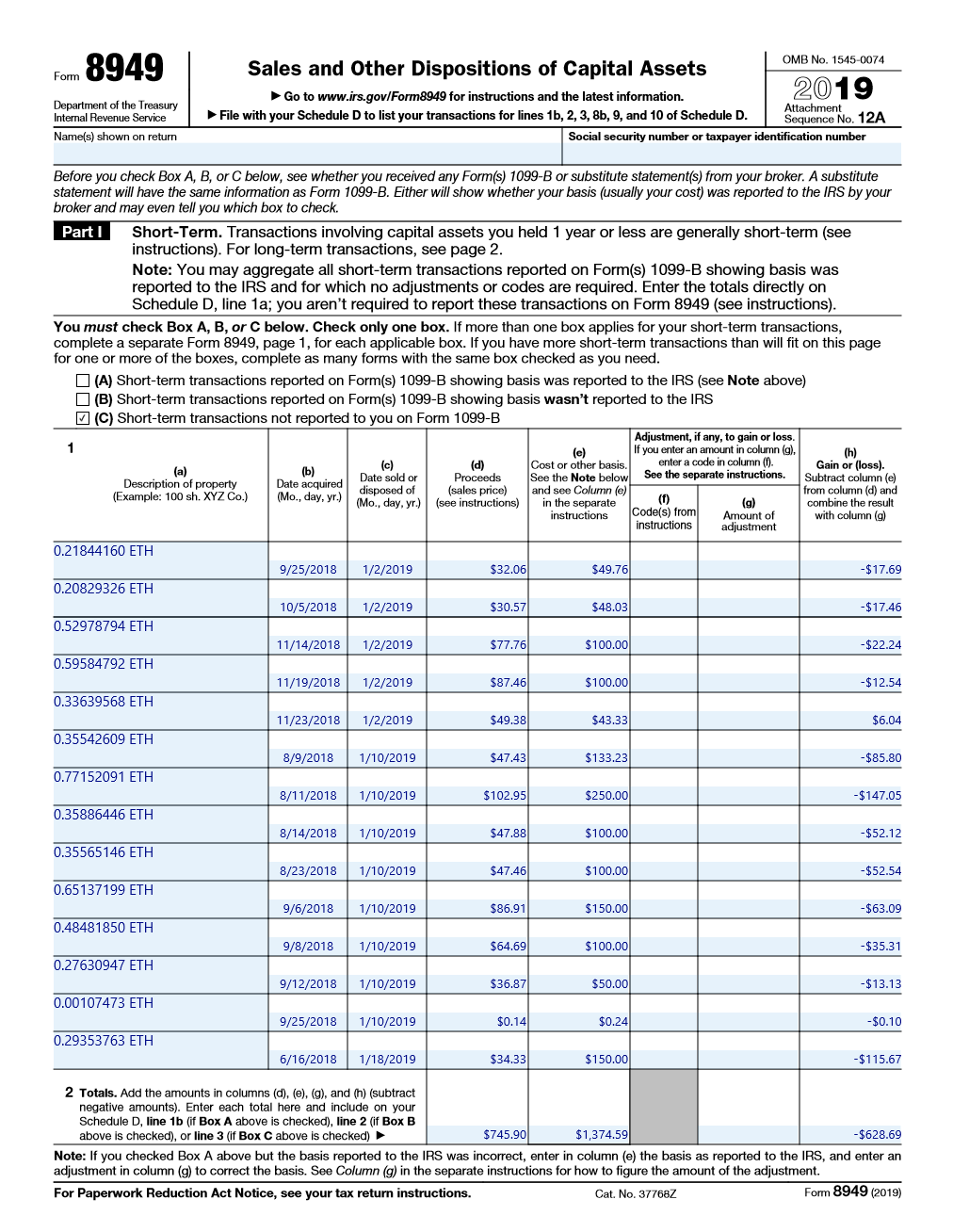

3. Calculate your capital losses and fill out IRS Form 8949.

4. Report your losses on Schedule D of your tax return.

5. Make sure to keep records of your transactions for future reference.

Follow these steps to ensure you properly claim your crypto losses on taxes. It’s important to consult with a tax professional for personalized advice.

Contents

- 1 How To Claim Crypto Losses on Taxes?

- 2 Keeping Track of Your Crypto Losses

- 3 How to Report Crypto Losses on Your Tax Returns

- 4 Maximize Your Tax Benefits

- 5 Key Takeaways:

- 6 Frequently Asked Questions

- 6.1 Q: Can I claim cryptocurrency losses on my taxes?

- 6.2 Q: How should I calculate my cryptocurrency losses?

- 6.3 Q: Can I deduct my crypto losses from previous years?

- 6.4 Q: What information should I gather to claim crypto losses on taxes?

- 6.5 Q: Should I seek professional help for claiming crypto losses?

- 6.6 Can You Write Off Your Crypto Losses? (Learn How) | CoinLedger

- 7 Summary

How To Claim Crypto Losses on Taxes?

When it comes to taxes, handling crypto losses can be a complex process. Whether you’ve experienced a dip in the value of your digital assets or made a bad investment, knowing how to claim crypto losses on your taxes is essential. In this article, we will explore the steps involved in claiming crypto losses, the documentation required, and some important considerations to keep in mind. By understanding the process, you can ensure that you maximize your tax benefits and minimize your losses.

Keeping Track of Your Crypto Losses

Before diving into the process of claiming crypto losses on taxes, it is crucial to maintain accurate records of your transactions. Whether you have lost digital assets due to theft, exchange hacks, or market fluctuations, proper documentation will be vital for claiming your losses. Start by documenting the date, type of cryptocurrency, amount lost, and the fair market value on the day of the loss.

It is also essential to keep track of any costs associated with your crypto investments, such as transaction fees, exchange fees, and legal fees. These expenses can be deducted when calculating your losses. Additionally, if you’ve incurred any expenses related to securing your crypto assets, such as hardware wallets or security software, make sure to include those as well.

By maintaining detailed records, you will have a solid foundation for accurately claiming your crypto losses on your tax returns.

How to Report Crypto Losses on Your Tax Returns

When it comes time to file your tax returns, reporting your crypto losses correctly is crucial. The exact process can vary depending on your jurisdiction, so it is always recommended to consult with a tax professional or certified accountant. However, here are the general steps involved in reporting crypto losses:

1. Determine your capital gains and losses: Calculate the difference between the cost basis (the price at which you acquired the crypto) and the fair market value on the day of the loss. This will help you determine your capital gains or losses.

2. Complete Schedule D: Use IRS Form 8949 to report your capital gains and losses from crypto transactions. Enter the details of each transaction and the corresponding gains or losses. Make sure to attach this form to your tax return.

3. Consider tax-loss harvesting: Tax-loss harvesting involves selling off crypto assets at a loss to offset any gains you may have and reduce your overall tax liability. It is a strategic way to maximize your tax benefits and minimize your losses.

Important Considerations for Claiming Crypto Losses on Taxes

1. Tax regulations vary by jurisdiction: Crypto tax regulations differ from country to country, and even within different states or provinces. Stay updated with the latest tax laws and guidelines specific to your location to ensure compliance.

2. Seek professional advice: Given the complexities of crypto taxation, it is always advisable to consult with a tax professional or certified accountant who specializes in cryptocurrency taxes. They can provide guidance tailored to your specific situation and help you optimize your tax strategy.

3. Document everything: We cannot emphasize this enough. Accurate record-keeping is essential when claiming crypto losses on taxes. Keep all supporting documentation, including receipts, transaction history, and any correspondence with exchanges or wallets.

Frequently Asked Questions About Claiming Crypto Losses on Taxes

1. Can I claim crypto losses on my taxes?

Yes, you can claim crypto losses on your taxes. However, the process and regulations may vary depending on your jurisdiction, so it is essential to familiarize yourself with the specific rules that apply to you.

2. Can I carry forward my crypto losses for future tax years?

In many jurisdictions, you can carry forward your crypto losses to future tax years if you are unable to offset them against capital gains in the current year. Again, consult with a tax professional to understand the rules that apply to your situation.

3. Should I amend a previous tax return to include crypto losses?

If you have previously filed a tax return without including your crypto losses, you may consider amending your return to claim those losses. However, it is crucial to consult with a tax professional as amending a tax return can have implications on your overall tax situation.

Maximize Your Tax Benefits

Claiming crypto losses on taxes can be a complex endeavor, but it is essential for minimizing your tax liability. By keeping accurate records, understanding the reporting process, and seeking professional advice, you can effectively claim your losses and maximize your tax benefits. Remember to stay updated with the latest tax regulations and guidelines in your jurisdiction, as the landscape of crypto taxation continues to evolve. By staying informed and proactive, you can navigate the world of crypto taxes with confidence.

Key Takeaways:

- When reporting crypto losses on taxes, it’s important to keep track of all transactions and the details of each trade.

- You can deduct cryptocurrency losses from your taxable income, but only up to a certain limit.

- To claim crypto losses, you need to file IRS Form 8949 and report each individual transaction on Schedule D.

- It’s crucial to accurately calculate the adjusted basis and fair market value for each cryptocurrency transaction.

- Seeking the assistance of a tax professional experienced in cryptocurrency taxation can ensure accurate reporting and maximize your tax benefits.

Frequently Asked Questions

In the world of cryptocurrencies, tax obligations can be confusing. Here are some commonly asked questions and answers about how to claim crypto losses on taxes.

Q: Can I claim cryptocurrency losses on my taxes?

A: Yes, you can claim cryptocurrency losses on your taxes. Just like with any investment, losses incurred from buying and selling cryptocurrencies can be used to offset other capital gains or taxable income. To claim these losses, you need to report them on your tax return using the IRS Form 8949.

Keep in mind that there are restrictions on the amount you can claim and the type of losses eligible. It is crucial to consult with a tax professional or accountant who is knowledgeable about cryptocurrency tax regulations to ensure you accurately report your losses.

Q: How should I calculate my cryptocurrency losses?

A: Calculating your cryptocurrency losses can be a complex process. Start by determining your cost basis, which is the original purchase price of the cryptocurrencies you sold. Then subtract the proceeds from the sales to calculate your capital loss. Keep detailed records of your transactions, including dates, amounts, and any fees paid.

Remember, the IRS requires you to report each transaction individually rather than providing a consolidated total. There are also specific rules for determining the holding period to classify your losses as short-term or long-term. If you find the calculation overwhelming, it’s advisable to seek the assistance of a tax professional.

Q: Can I deduct my crypto losses from previous years?

A: Unfortunately, you cannot deduct crypto losses from previous years on your current tax return. However, you may be able to carry forward your losses to future years. The IRS allows you to carry forward your net capital losses indefinitely until they are fully utilized.

Keep track of your losses and include them on your tax return each year until they are fully deducted. Properly documenting your losses and carrying them forward can help you reduce your tax liability in future years.

Q: What information should I gather to claim crypto losses on taxes?

A: When claiming crypto losses on your taxes, it’s important to gather all the necessary information to accurately report your transactions. This includes records of the dates and amounts of your cryptocurrency purchases and sales, transaction fees, and any other applicable expenses.

Make sure to keep track of the fair market value of the cryptocurrencies at the time of each transaction, as this will be used to calculate your gains or losses. Additionally, document any supporting documents or statements received from cryptocurrency exchanges or wallets. Proper record-keeping will help you file your taxes correctly and provide evidence in case of an audit.

Q: Should I seek professional help for claiming crypto losses?

A: Seeking professional help for claiming crypto losses on taxes is highly recommended, especially if you are not well-versed in tax regulations or have complex transactions. A tax professional or an accountant with knowledge of cryptocurrency tax laws can ensure you comply with all reporting requirements and maximize your deductions.

Having a professional on your side can help you navigate the complexities of tax laws, avoid errors that could trigger an audit, and potentially save you money by maximizing your deductions. They can also keep you updated on any changes to crypto tax regulations, ensuring your tax returns remain accurate and compliant.

Can You Write Off Your Crypto Losses? (Learn How) | CoinLedger

Summary

So, if you’ve had losses in your cryptocurrency investments and want to claim them on your taxes, here’s what you need to know. First, keep track of your transactions and the prices at the time of the transactions. Second, report your losses on your tax return using the appropriate form. Make sure you have all the necessary documentation to support your claim. Remember, it’s important to consult with a tax professional for guidance tailored to your specific situation. Claiming crypto losses on taxes might seem complicated, but with the right approach, you can navigate the process successfully.