Are you curious about how digital currency works? Well, let me break it down for you in a fun and engaging way. You see, digital currency is like money that lives on the internet instead of in your piggy bank. It may seem a bit mysterious, but don’t worry, I’ll guide you through it step by step!

Picture this: instead of using physical coins and paper bills, digital currency exists as digital files stored on computers and online platforms. It’s just like having virtual money that you can use to buy things or trade with people all over the world. Pretty cool, right?

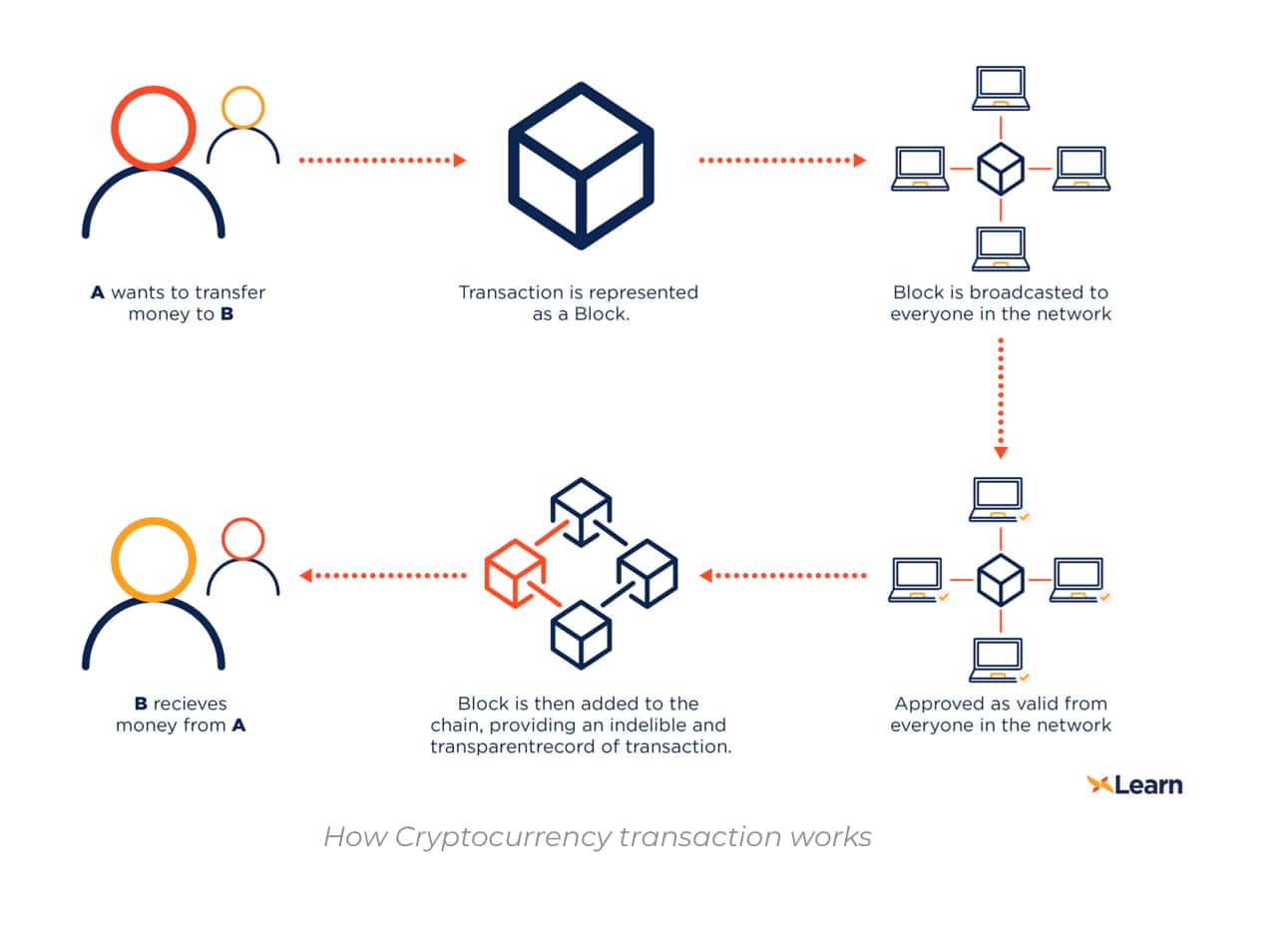

But how does it actually work? Well, digital currency transactions are recorded on something called a blockchain, which is like a giant digital ledger. Each transaction is verified and added to the blockchain by a network of computers. This way, everyone can see and validate the transactions, ensuring transparency and security.

So, next time you hear about Bitcoin, Ethereum, or other digital currencies, remember that they are a modern and exciting way to handle money in the digital world. Get ready to dive deeper into the world of digital currency and discover all the amazing possibilities it offers!

Curious about how digital currency works? Let’s dive in! Digital currency, also known as cryptocurrency, operates on a decentralized technology called blockchain. It allows secure, peer-to-peer transactions without the need for intermediaries like banks. Here’s a simplified breakdown:

- Ownership records are stored on the blockchain.

- Transactions are verified and added to the blockchain by “miners.”

- Miners use complex algorithms to solve mathematical problems.

- Once a problem is solved, the transaction is confirmed and added to the blockchain.

- The blockchain is constantly updated across all nodes, ensuring transparency and security.

Contents

- 1 How Does Digital Currency Work?

- 2 The Basics of Digital Currency

- 3 Benefits of Digital Currency

- 4 The Future of Digital Currency

- 5 In Conclusion

- 6 Key Takeaways: How Does Digital Currency Work?

- 7 Frequently Asked Questions

- 7.1 1. How is digital currency different from traditional currency?

- 7.2 2. How are digital currencies created?

- 7.3 3. How are digital currency transactions secured?

- 7.4 4. Can digital currency be used for everyday transactions?

- 7.5 5. Are digital currencies safe to use?

- 7.6 What is Digital Currency | Types of Digital currency | CryptoCurrency | digital currency explained

- 8 Summary:

How Does Digital Currency Work?

Digital currency has become a buzzword in recent years, with cryptocurrencies like Bitcoin dominating the headlines. But how exactly does digital currency work? In this article, we will delve into the world of digital currency, exploring its mechanisms, benefits, and potential risks. From the underlying technology to the process of transactions, we will demystify the concept of digital currency and help you understand how it operates in the modern financial landscape.

The Basics of Digital Currency

Before we dive into the intricacies of digital currency, let’s start with the basics. In simple terms, digital currency is a form of currency that exists only in electronic form. Unlike traditional physical cash or coins, digital currency is intangible and can be stored electronically on devices such as computers or smartphones. It is typically decentralized and operates using cryptographic technology to secure transactions and control the creation of new units.

One of the most well-known forms of digital currency is Bitcoin. Created in 2009, Bitcoin was the first decentralized cryptocurrency and sparked a revolution in the world of finance. Since then, numerous other cryptocurrencies have emerged, each with its unique features and uses. These digital currencies are based on blockchain technology, a distributed ledger system that records all transactions transparently and securely.

The Role of Blockchain Technology

At the heart of digital currency is blockchain technology. Blockchain is a decentralized ledger that records every transaction made using a particular cryptocurrency. Imagine a giant digital spreadsheet that is constantly updated and duplicated across a network of computers. Each transaction, or block, is added to the chain in a chronological order, creating an immutable record of all transactions.

Blockchain technology ensures security and transparency. It eliminates the need for a centralized authority, such as a bank or government, to validate transactions. Instead, transactions are verified by a network of computers known as nodes. These nodes work together to confirm the validity of transactions and add them to the blockchain. As a result, digital currency transactions can be conducted directly between individuals without the need for intermediaries, reducing costs and increasing efficiency.

Moreover, blockchain technology provides an added layer of security by using cryptographic algorithms to encrypt and protect transactions. Each transaction is linked to the previous one, creating a chain of blocks that is nearly impossible to alter or tamper with. This ensures the integrity of the digital currency system and prevents fraud or double-spending.

The Process of Digital Currency Transactions

Now that we understand the basics of digital currency and blockchain technology, let’s explore how transactions are conducted using digital currency. The process typically involves three main steps: creating a digital wallet, initiating a transaction, and validating the transaction.

1. Creating a Digital Wallet: To use digital currency, you need a digital wallet. A digital wallet is a software application that allows you to store, send, and receive digital currency. It generates a pair of cryptographic keys: a public key, which is used to receive funds, and a private key, which is used to access and transfer funds. The wallet is encrypted and secured with passwords or biometric authentication to protect against unauthorized access.

2. Initiating a Transaction: Once you have a digital wallet, you can initiate a transaction. This involves specifying the recipient’s digital wallet address and the amount of digital currency you wish to send. The transaction is then broadcasted to the network of nodes, who verify the transaction’s validity before adding it to the blockchain.

3. Validating the Transaction: The network of nodes collaborates to validate the transaction. They check the digital signatures, verify that the sender has sufficient funds, and ensure that the transaction is not a duplicate or fraudulent. Once the transaction is validated, it is added to the blockchain and becomes a permanent part of the digital currency’s transaction history.

Benefits of Digital Currency

Now that we have explored how digital currency works, let’s dive into some of its key benefits. Digital currency offers several advantages over traditional fiat currencies, including:

- Decentralization: Digital currency operates on decentralized networks, meaning that no single entity or authority has control over it. This increases transparency, reduces the risk of censorship, and promotes financial inclusivity.

- Lower Transaction Fees: Digital currency transactions often involve lower fees compared to traditional banking systems. Without intermediaries, such as banks or payment processors, the cost of transactions can be significantly reduced.

- Global Accessibility: Digital currency transcends national borders, allowing for seamless international transactions. It eliminates the need for currency conversions and reduces the reliance on traditional banking systems.

- Enhanced Security: Digital currency transactions are protected by advanced cryptographic algorithms and decentralized networks. This makes it incredibly difficult for hackers or fraudsters to manipulate or compromise the system.

The Future of Digital Currency

As digital currency continues to gain traction and mainstream acceptance, its future looks promising. The potential applications of digital currency extend beyond financial transactions, with industries such as healthcare, supply chain management, and voting exploring its uses. Additionally, central banks around the world are exploring the development of Central Bank Digital Currencies (CBDCs), which could revolutionize traditional monetary systems.

However, it is important to note that digital currency still faces challenges and regulatory hurdles. Concerns about scalability, energy consumption, and the potential for illicit activities persist. Striking a balance between innovation and regulation will be crucial for the widespread adoption and acceptance of digital currency in the future.

In Conclusion

Digital currency is revolutionizing the way we think about money and financial transactions. Its decentralized nature, efficient processes, and enhanced security offer numerous benefits to individuals and businesses alike. As technology continues to advance and regulatory frameworks evolve, digital currency is poised to shape the future of finance. Whether you are a cryptocurrency enthusiast or a curious observer, understanding how digital currency works is essential in navigating the ever-changing financial landscape.

Key Takeaways: How Does Digital Currency Work?

- Digital currency is a type of currency that exists only in electronic form.

- It uses cryptography to secure transactions and control the creation of new units.

- Transactions are recorded on a digital ledger called a blockchain.

- Common forms of digital currency include Bitcoin and Ethereum.

- Digital currency can be used for online purchases, investments, and peer-to-peer transactions.

Frequently Asked Questions

Welcome to our FAQ section on how digital currency works! Here, we’ll cover some common questions to help you better understand the world of digital currencies and how they function in today’s digital age.

1. How is digital currency different from traditional currency?

Digital currency, also known as cryptocurrency, is a form of currency that exists solely in electronic form. Unlike traditional currency, such as physical cash or coins, digital currency is intangible and operates on decentralized technology known as blockchain. This means that digital currencies are not controlled or regulated by any single entity, like a government or central bank.

Digital currencies also differ from traditional currency in terms of how transactions occur. While traditional currency transactions involve banks or financial institutions as intermediaries, digital currency transactions are verified and recorded on a blockchain network by a decentralized network of computers. This decentralized nature of digital currencies provides increased security, transparency, and removes the need for central intermediaries.

2. How are digital currencies created?

Digital currencies are created through a process called mining. Mining involves using powerful computers to solve complex mathematical problems that validate and verify transactions on the blockchain network. When a miner successfully solves a mathematical problem, they are rewarded with a certain amount of digital currency.

These mathematical problems require a significant amount of computational power and energy consumption. The difficulty of these problems is adjusted automatically by the blockchain network to ensure a steady and controlled creation of digital currency. It’s important to note that not all digital currencies are created through mining, as some are pre-mined or issued by a central authority.

3. How are digital currency transactions secured?

Digital currency transactions are secured through cryptographic techniques and the decentralized nature of blockchain technology. Each transaction is encrypted and linked to the previous transaction on the blockchain, creating a chain of verified and tamper-proof transactions.

Additionally, blockchain networks rely on a consensus mechanism, such as Proof of Work or Proof of Stake, to validate and confirm transactions. These mechanisms ensure that the majority of the network agrees on the validity of each transaction, making it extremely difficult for anyone to manipulate or falsify transaction records.

4. Can digital currency be used for everyday transactions?

Yes, digital currency can be used for everyday transactions, depending on its acceptance and integration into the mainstream economy. While some businesses and online platforms already accept digital currency as a form of payment, its adoption in physical stores and traditional financial institutions is still limited.

However, with the increasing popularity and global interest in digital currencies, efforts are being made to make them more accessible and user-friendly for everyday transactions. Some digital currency projects are focused on developing scalable solutions and partnerships with existing financial institutions to enable widespread acceptance and usage.

5. Are digital currencies safe to use?

Digital currencies can be considered safe to use, but it’s essential to exercise caution and take necessary security measures. As with any form of currency, there are risks associated with digital currencies, such as the potential for hacking, scams, and market volatility.

To enhance the security of digital currency holdings, individuals are advised to store their digital currencies in secure wallets that employ strong encryption and utilize best practices for password protection. Additionally, staying informed about the latest security practices and being mindful of potential scams is crucial to ensure a safe digital currency experience.

What is Digital Currency | Types of Digital currency | CryptoCurrency | digital currency explained

Summary:

So, to sum it up, digital currency works like virtual money that you can use online. It’s stored in special digital wallets and can be used for buying things or trading. Instead of physical coins or notes, it’s all done electronically!

Digital currency relies on blockchain technology, which keeps a record of every transaction and makes sure it’s secure. This means you can trust that your digital money is safe. Just like regular money, the value of digital currency can change, so it’s important to keep an eye on its value if you have some.

Overall, digital currency is a new and exciting way to buy and sell things online. It’s easy to use and has the potential to change the way we think about money. So, if you’re interested in technology and finance, learning more about digital currency could be a great idea!