Diving into the exciting world of finance and technology, let’s explore the concept of using reinforcement learning for trading optimization. 📊💡

In this age of advanced algorithms and artificial intelligence, traders are constantly seeking innovative ways to maximize their profits. And that’s where reinforcement learning comes into play! 🚀

By harnessing the power of machine learning, traders can train their algorithms to make smarter, data-driven decisions, ultimately optimizing their trading strategies for maximum gains. Let’s uncover the fascinating world of using reinforcement learning for trading optimization!

Keywords: Using Reinforcement Learning for Trading Optimization

Contents

- 1 Using Reinforcement Learning for Trading Optimization: Revolutionizing the Financial Markets

- 2 The Power of Reinforcement Learning in Trading Optimization

- 3 Key Takeaways – Using Reinforcement Learning for Trading Optimization

- 4 Frequently Asked Questions

- 4.1 1. How does reinforcement learning contribute to trading optimization?

- 4.2 2. What are the benefits of using reinforcement learning for trading optimization?

- 4.3 3. Are there any limitations to using reinforcement learning for trading optimization?

- 4.4 4. Can reinforcement learning be applied to different types of financial markets?

- 4.5 5. How can I get started with using reinforcement learning for trading optimization?

- 4.6 Reinforcement Learning for Trading Tutorial | $GME RL Python Trading

- 5 Summary

Using Reinforcement Learning for Trading Optimization: Revolutionizing the Financial Markets

Trading optimization is a critical aspect of financial markets, and finding effective strategies to maximize returns and minimize risks is a constant pursuit for traders and investors. In recent years, a groundbreaking technology known as reinforcement learning has emerged as a game-changer in trading optimization. With its ability to learn from historical data and make informed decisions, reinforcement learning is revolutionizing the way trading strategies are developed and executed.

The Power of Reinforcement Learning in Trading Optimization

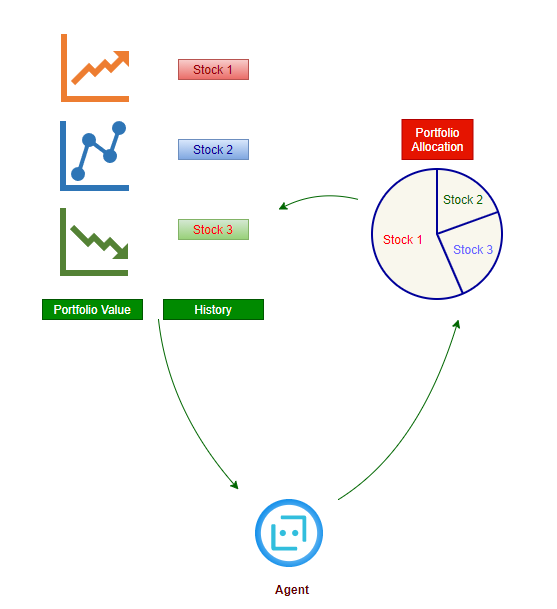

Reinforcement learning, a branch of artificial intelligence, enables computers to learn and make decisions through iterative trial and error interactions with the environment. In the context of trading optimization, reinforcement learning algorithms analyze historical market data, identify patterns, and optimize trading strategies accordingly. The key advantage of reinforcement learning lies in its ability to adapt to changing market conditions and learn from real-time feedback.

By employing reinforcement learning for trading optimization, traders can benefit from the following advantages:

- Adaptability: Reinforcement learning algorithms can adjust trading strategies to fit evolving market conditions. They constantly learn from new data and adapt their decision-making processes accordingly, enabling traders to stay ahead of the curve.

- Efficiency: Traditional trading strategies often require extensive manual analysis and adjustment. With reinforcement learning, the process becomes automated, significantly reducing the time and effort required for optimization.

- Complexity Handling: Financial markets are complex, with countless factors influencing asset prices. Reinforcement learning algorithms have the capacity to handle this complexity by analyzing vast amounts of data and identifying patterns that human traders might miss.

- Risk Management: Reinforcement learning techniques can be utilized to optimize risk management strategies. By continuously learning from historical data, these algorithms can identify and mitigate risks, ensuring more secure and profitable trading operations.

Reinforcement Learning Techniques for Trading Optimization

There are various reinforcement learning techniques that can be employed for trading optimization. One popular approach is the Q-learning algorithm, which provides an efficient way to maximize long-term rewards based on an agent’s actions. Q-learning is particularly effective in optimizing trading strategies that involve dynamic decision-making under uncertain market conditions.

Another powerful technique is policy gradients, which learn directly from the continuous actions taken by an agent. Policy gradient methods are advantageous when dealing with trading scenarios that require continuous adjustments and fine-tuning of strategies.

Furthermore, deep reinforcement learning, integrating neural networks with reinforcement learning algorithms, has gained significant traction in recent years. Deep reinforcement learning enables the extraction of valuable features from complex market data, enhancing the learning capabilities and accuracy of trading models.

The Challenges and Future Directions of Reinforcement Learning in Trading Optimization

While reinforcement learning offers immense potential for trading optimization, there are still challenges to overcome. One major hurdle is the availability and quality of data. Training reinforcement learning algorithms requires access to vast amounts of historical market data, and ensuring the accuracy and reliability of this data is crucial for effective learning.

Furthermore, reinforcement learning algorithms can sometimes be sensitive to parameter selection and fine-tuning. Choosing the right hyperparameters and optimizing the training process is essential for achieving robust and profitable trading strategies.

Looking ahead, advancements in reinforcement learning, such as the integration of meta-learning and improved data collection techniques, hold promise for even greater breakthroughs in trading optimization. The combination of reinforcement learning with other technologies, such as natural language processing and sentiment analysis, has the potential to enhance decision-making and generate valuable insights from unstructured market data.

How to Leverage Reinforcement Learning for Trading Optimization

Interested in harnessing the power of reinforcement learning for trading optimization? Here are some tips to get started:

- Data Collection: Gather comprehensive and reliable historical market data to serve as the foundation for training and testing your reinforcement learning algorithms.

- Algorithm Selection: Explore different reinforcement learning techniques and algorithms to identify the most suitable approach for your trading optimization goals.

- Hyperparameter Tuning: Carefully fine-tune the hyperparameters of your reinforcement learning models to achieve optimal performance.

- Monitor and Evaluate: Continuously monitor the performance of your reinforcement learning-based trading strategies and make necessary adjustments to ensure their effectiveness.

- Stay Informed: Keep up with the latest advancements in reinforcement learning and its applications in trading optimization. Attend conferences, read research papers, and engage with the community to stay at the forefront of this rapidly evolving field.

The integration of reinforcement learning into trading optimization is reshaping the financial industry. By leveraging this cutting-edge technology, traders and investors can unlock new opportunities and achieve greater profitability. Embrace the power of reinforcement learning and embark on a transformative journey in the world of trading optimization.

Note: The information provided in this article is for educational purposes only and should not be taken as financial advice. Always conduct thorough research and seek professional guidance before making any investment decisions.

Key Takeaways – Using Reinforcement Learning for Trading Optimization

- Reinforcement learning is a technique that can be used to optimize trading strategies.

- It involves training a computer program to make decisions based on rewards and penalties.

- By using reinforcement learning, traders can improve their decision-making process and increase profitability.

- This approach can adapt to changing market conditions and learn from historical data.

- Reinforcement learning can help traders identify patterns and trends, leading to more informed trading decisions.

Frequently Asked Questions

Welcome to our frequently asked questions section on using reinforcement learning for trading optimization. Here, we’ll address some common queries related to this topic. Read on to learn more!

1. How does reinforcement learning contribute to trading optimization?

Reinforcement learning is a type of machine learning that focuses on decision-making through trial and error. When applied to trading, it allows algorithms to learn and adapt to market conditions, resulting in optimized trading strategies. By using past data, reinforcement learning algorithms continuously improve their policies and adjust their actions, maximizing returns and minimizing risks.

Through reinforcement learning, trading systems can automatically detect patterns in the market, make predictions, and take actions based on those predictions. This approach enables traders to optimize their strategies in real-time, increasing the chances of making profitable trades and reducing losses.

2. What are the benefits of using reinforcement learning for trading optimization?

One major benefit of using reinforcement learning for trading optimization is the ability to adapt to changing market conditions. Traditional trading strategies may become ineffective as the market evolves, but reinforcement learning algorithms can continuously learn and adjust their strategies accordingly. This adaptability helps traders stay ahead of the curve and make more informed decisions.

Additionally, reinforcement learning allows traders to automate trading processes, eliminating human biases and emotional decision-making. These algorithms can process large amounts of data and make complex calculations in real-time, leading to faster and more accurate trading decisions. With automated reinforcement learning systems, traders can also avoid the limitations of human capacity and monitor multiple markets simultaneously.

3. Are there any limitations to using reinforcement learning for trading optimization?

While reinforcement learning has shown great promise in trading optimization, it does come with certain limitations. One key challenge is the need for high-quality and reliable input data. Reinforcement learning algorithms heavily rely on historical and real-time market data to make accurate predictions. Therefore, if the data is flawed or insufficient, it can lead to inaccurate and unreliable trading strategies.

Another limitation is the potential for overfitting. Overfitting occurs when a model becomes too specialized in the available data, leading to poor performance when applied to new or unseen data. To mitigate this risk, traders need to carefully design and train their reinforcement learning models, ensuring they strike the right balance between generalization and specificity.

4. Can reinforcement learning be applied to different types of financial markets?

Absolutely! Reinforcement learning can be applied to various financial markets, including stocks, bonds, commodities, and foreign exchange. The underlying principles and techniques can be adapted to different market dynamics and trading strategies. Whether you’re a stock trader, a currency trader, or a commodity trader, reinforcement learning can help optimize your trading decisions.

However, it’s worth noting that different financial markets have unique characteristics and complexities. Traders should carefully consider the specific dynamics of each market and tailor their reinforcement learning models accordingly. This may involve adjusting input data, reward functions, and other parameters to ensure the model adequately captures the behavior of the particular market.

5. How can I get started with using reinforcement learning for trading optimization?

If you’re interested in exploring reinforcement learning for trading optimization, there are a few steps you can take to get started. First, it’s essential to gain a solid understanding of both reinforcement learning concepts and trading strategies. This will help you identify the best approaches and algorithms for your specific trading goals.

Next, explore existing research and literature on reinforcement learning in trading. Many academic papers and online resources provide valuable insights and methodologies that you can build upon. Experiment with different frameworks and libraries, such as TensorFlow or PyTorch, to implement and test your reinforcement learning models. Finally, backtest and validate your strategies using historical data before deploying them in real-time trading environments.

Reinforcement Learning for Trading Tutorial | $GME RL Python Trading

Summary

Trading optimization can sometimes be tricky, but using reinforcement learning can help. Reinforcement learning is a fancy term for training a computer program to make better decisions through trial and error. It’s like teaching a robot to learn from its mistakes and make smarter choices in the future. By applying reinforcement learning to trading, we can improve our investment strategies and increase our chances of making profitable trades. This method takes into account different factors like market trends, historical data, and risk tolerance to make informed decisions. So, if you want to optimize your trading game, give reinforcement learning a try!

In conclusion, reinforcement learning is a powerful tool we can use to improve trading strategies. It enables us to train computer programs to make smarter decisions based on experience. By using this approach, we can increase our chances of making profitable trades and optimizing our investment game. So, go ahead and explore the world of reinforcement learning for trading optimization!