Do you have crypto? Wondering if you need to report it on your taxes? Well, buckle up because we’re about to dive into the world of cryptocurrency and tax obligations. So, let’s get started!

Cryptocurrency has become increasingly popular, but when it comes to taxes, things can get a bit tricky. The short answer is yes, you generally have to report your crypto holdings and transactions on your tax return. But don’t worry, we’re here to break it down for you in plain English.

Now, you might be wondering why you have to report crypto on your taxes. Well, the IRS considers cryptocurrency as property, not currency. And just like any other property, like stocks or real estate, it’s subject to taxes when you buy, sell, or use it. So, it’s important to stay compliant and avoid any potential headaches down the line.

So, whether you’re a seasoned crypto investor or just getting started, understanding your tax obligations is crucial. In the next sections, we’ll explore the specifics of reporting crypto on your taxes and provide some helpful tips along the way. So, let’s dig into the details and get you on the right track with your crypto taxes!

Curious about reporting crypto on your taxes? It’s important to note that tax regulations regarding cryptocurrencies vary by country. In the United States, for example, the IRS considers cryptocurrency as property, so you need to report any gains or losses from crypto transactions. Failure to do so may result in penalties. To ensure compliance, keep track of your transactions and consult a tax professional for guidance.

Contents

- 1 Do You Have to Report Crypto on Taxes?

- 2 Understanding Cryptocurrency and Taxes: An Overview

- 3 Crypto Tax Regulations Around the World

- 4 Final Thoughts

- 5 Key Takeaways: Do You Have To Report Crypto on Taxes?

- 6 Frequently Asked Questions

- 6.1 1. How is cryptocurrency treated for tax purposes?

- 6.2 2. Do I have to report cryptocurrency on my taxes?

- 6.3 3. Can I use cryptocurrency losses to offset other capital gains?

- 6.4 4. What if I haven’t reported my cryptocurrency in previous years?

- 6.5 5. Do I need to pay taxes on cryptocurrency if I haven’t converted it back into fiat currency?

- 6.6 Crypto Tax Reporting (Made Easy!) – CryptoTrader.tax / CoinLedger.io – Full Review!

- 7 Summary

Do You Have to Report Crypto on Taxes?

As cryptocurrencies gain popularity and become more mainstream, the question of whether or not to report crypto on taxes becomes increasingly important. With the rise of digital currencies like Bitcoin and Ethereum, many individuals are investing, trading, and earning income through crypto-related activities. But how does the tax system treat these virtual assets? In this article, we will delve into the intricate world of crypto taxes, exploring the reporting requirements, potential benefits, and key considerations for individuals navigating the crypto tax landscape.

Understanding Cryptocurrency and Taxes: An Overview

Before we dive into the specifics of reporting crypto on taxes, it is essential to understand the basics of cryptocurrency and how it is viewed by tax authorities. Cryptocurrency, often referred to as digital or virtual currency, is a form of decentralized digital money that uses cryptography for secure financial transactions. Unlike traditional fiat currencies, cryptocurrencies operate independently of central banks and governments.

For tax purposes, most jurisdictions treat cryptocurrencies as property rather than currency. This means that crypto transactions, such as buying, selling, or trading, may trigger taxable events. Additionally, if you earn income in the form of cryptocurrencies, whether through mining, staking, or receiving payments, it is likely subject to taxation as well. However, the specific rules and regulations regarding crypto taxes can vary significantly from country to country. It is important to consult with a tax professional or refer to the tax guidelines in your jurisdiction to ensure compliance.

How to Determine if You Need to Report Crypto Transactions

Now that we have established the general principles of cryptocurrency and taxes, let’s delve into the factors that determine whether you need to report your crypto transactions. It is crucial to keep in mind that tax requirements can vary based on your jurisdiction, so it is essential to consult with a tax professional or refer to the specific guidelines in your country.

1. Trading Cryptocurrencies: If you actively trade cryptocurrencies on exchanges, buying and selling different digital assets within a specified timeframe, you are likely subject to tax reporting requirements. These trades may be treated as capital gains or losses, similar to stocks and other investment assets.

2. Mining Cryptocurrencies: If you participate in cryptocurrency mining, the rewards you receive for contributing computing power may be deemed taxable income. The specific rules regarding mining income can vary, so it is crucial to understand the guidelines in your jurisdiction.

3. Receiving Crypto Payments: If you receive cryptocurrencies as payment for goods or services, it is necessary to report the fair market value of the crypto at the time of receipt. This income may be subject to regular income tax rates or treated as self-employment income, depending on your circumstances.

Benefits of Reporting Crypto on Taxes

While reporting crypto on taxes might seem daunting, there are several benefits to complying with your tax obligations:

- Avoiding Penalties and Audits: Failing to report your crypto transactions can lead to penalties, fines, or even audits from tax authorities. By accurately reporting your transactions, you mitigate the risk of negative repercussions.

- Establishing a Clear Paper Trail: By documenting your crypto transactions and reporting them on your tax return, you create a clear paper trail. This can be invaluable in the event of an audit or if you need to provide proof of ownership or value.

- Building Trust and Legitimacy: Complying with tax regulations helps legitimize the cryptocurrency industry and build trust with regulators, financial institutions, and potential investors. Increased legitimacy can contribute to the long-term stability and growth of the crypto market.

Key Considerations for Reporting Crypto on Taxes

Reporting crypto on taxes requires careful consideration and attention to detail. Here are some key factors to keep in mind:

- Record-Keeping: It is crucial to maintain detailed records of your cryptocurrency transactions, including dates, amounts, cost basis, and any relevant supporting documentation. This will facilitate accurate reporting and help substantiate your tax positions.

- Valuation and Currency Conversion: Determining the fair market value of cryptocurrencies at the time of transaction or receipt can be challenging. Keep up-to-date with market prices and consider using reputable cryptocurrency price index services to determine accurate valuations.

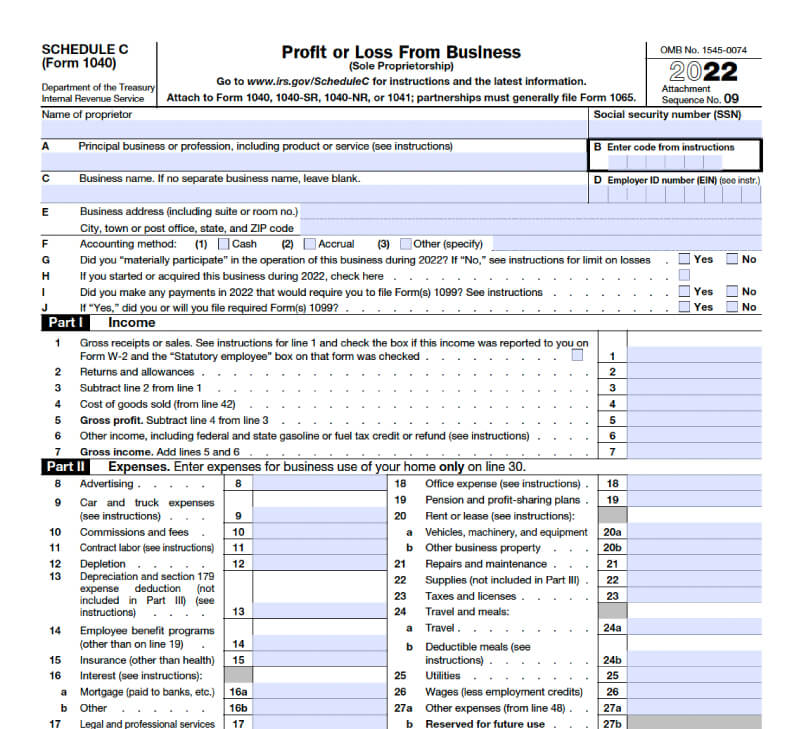

- Tax Reporting Tools: Utilize specialized crypto tax reporting software or platforms to streamline the process and ensure accurate calculations. These tools can automate the aggregation of transaction data, calculate gains/losses, and generate tax-ready reports.

Crypto Tax Regulations Around the World

In addition to understanding the general principles of reporting crypto on taxes, it is essential to be aware of the specific regulations in your country. Here are three examples of how different jurisdictions treat cryptocurrencies:

United States

In the United States, the Internal Revenue Service (IRS) treats cryptocurrencies as property for tax purposes. This means that capital gains tax rules apply to crypto transactions. Each time you buy, sell, or trade cryptocurrencies, you may trigger a taxable event. The onus is on the individual to calculate and report their gains or losses accurately.

United Kingdom

In the United Kingdom, HM Revenue & Customs (HMRC) treats cryptocurrencies as assets rather than currency. As a result, when you dispose of cryptocurrencies, you may be liable to pay Capital Gains Tax on any profits exceeding the annual tax-free allowance.

Australia

In Australia, the Australian Taxation Office (ATO) treats cryptocurrencies as property, similar to the United States. Bitcoin and other cryptocurrencies are subject to capital gains tax, and transactions involving crypto must be reported on individual tax returns. Additionally, crypto received as payment for goods or services is considered ordinary income and must be reported accordingly.

It is essential to consult with a tax professional or refer to the specific guidelines in your jurisdiction for the most up-to-date and accurate information regarding crypto tax regulations.

Final Thoughts

When it comes to reporting crypto on taxes, the rules and regulations can be complex and ever-changing. However, it is crucial to understand your obligations and comply with the tax authorities in your jurisdiction. By accurately reporting your crypto transactions, you can avoid penalties, establish a clear paper trail, and contribute to the overall legitimacy and growth of the cryptocurrency industry. Remember to consult with a tax professional to ensure compliance with the specific guidelines in your country, as this article provides a general overview and should not be considered tax advice.

Key Takeaways: Do You Have To Report Crypto on Taxes?

- Reporting your cryptocurrency earnings and transactions to the tax authorities is essential.

- Failure to report crypto on your taxes may result in penalties and fines.

- Even if you think your crypto transactions are anonymous, the IRS may still be able to track them.

- Keep detailed records of your crypto transactions, including buying, selling, and trading.

- If you’re unsure about your tax obligations, consult with a tax professional or accountant.

Frequently Asked Questions

Reporting crypto on taxes can be a complex topic. Here are some commonly asked questions and answers to help you understand the process.

1. How is cryptocurrency treated for tax purposes?

For tax purposes, cryptocurrency is treated as property, not currency. This means that any transactions involving cryptocurrency, such as buying, selling, or trading, may have tax implications. Just like any other property, gains or losses from cryptocurrency transactions are subject to taxation.

When you report cryptocurrency on your taxes, you will need to calculate your capital gains or losses. This is done by taking the difference between the fair market value of the cryptocurrency when you acquired it and the fair market value when you disposed of it. It’s important to keep accurate records of your cryptocurrency transactions to ensure you report them correctly.

2. Do I have to report cryptocurrency on my taxes?

Yes, you are required to report cryptocurrency on your taxes. The IRS treats cryptocurrency as property, and any gains or losses from cryptocurrency transactions are subject to taxation. Even if you think your cryptocurrency transactions are small or insignificant, you still need to report them.

Failure to report your cryptocurrency transactions can result in penalties and interest. The IRS has been increasing their focus on cryptocurrency tax compliance, and they have even sent warning letters to taxpayers who may have failed to report their cryptocurrency activities. It’s always best to be upfront and transparent with your cryptocurrency transactions to avoid any potential issues.

3. Can I use cryptocurrency losses to offset other capital gains?

Yes, you can use cryptocurrency losses to offset other capital gains. If you have capital losses from your cryptocurrency transactions, you can use those losses to reduce or offset any capital gains you may have from other investments.

However, there are limitations on the amount of losses you can deduct in a tax year. Individuals can deduct up to $3,000 in capital losses per year ($1,500 if married filing separately), with the option to carry over any additional losses to future years. It’s important to consult with a tax professional who can guide you on how to properly report and utilize your cryptocurrency losses.

4. What if I haven’t reported my cryptocurrency in previous years?

If you haven’t reported your cryptocurrency in previous years, it’s important to take action and correct any mistakes. The IRS has been cracking down on cryptocurrency tax compliance, and failure to report your cryptocurrency activities can result in penalties and interest.

You can amend your previous tax returns to include the cryptocurrency transactions you failed to report. The IRS has a voluntary disclosure program that allows taxpayers to come forward and report previously undisclosed income or assets. By proactively addressing the issue, you can avoid more serious consequences down the line.

5. Do I need to pay taxes on cryptocurrency if I haven’t converted it back into fiat currency?

Yes, you are still required to pay taxes on cryptocurrency even if you haven’t converted it back into fiat currency. The IRS treats cryptocurrency as property, and any gains or losses from cryptocurrency transactions are subject to taxation.

When you engage in cryptocurrency transactions, such as trading one cryptocurrency for another, it triggers a taxable event. The gains or losses from these transactions need to be reported on your taxes, regardless of whether you converted the cryptocurrency back into traditional currency. It’s important to keep accurate records of all your cryptocurrency transactions to ensure you report them correctly.

Crypto Tax Reporting (Made Easy!) – CryptoTrader.tax / CoinLedger.io – Full Review!

Summary

So, here’s what you need to take away from all of this crypto tax talk. The first thing is that the IRS considers cryptocurrency to be taxable property. That means if you buy, sell, or trade crypto, you might have to pay taxes on it. The second thing is that even if you think you can get away with not reporting your crypto transactions, it’s not a good idea. The IRS is cracking down on crypto tax evasion and they have ways of finding out if you’re not being honest. So be smart, report your crypto on your taxes and avoid any trouble with the IRS.