If you’ve ever wondered how experts spot unusual behavior in the stock market, you’re in for a treat! Today, we’ll dive into the exciting world of using machine learning to identify market anomalies. Machine learning, a branch of artificial intelligence, helps us analyze massive amounts of data to uncover patterns and detect when something out of the ordinary is happening.

Market anomalies can be like hidden gems, providing opportunities for investors to make smart decisions. By leveraging machine learning algorithms, we can train computers to sift through vast amounts of historical data, searching for patterns and anomalies that might indicate market distortions or abnormal behavior.

Using sophisticated techniques, these models can identify irregularities in stock prices, trading volume, or other market indicators. This helps investors stay ahead of the game, spotting potential risks or opportunities that might otherwise go unnoticed. So buckle up and get ready to explore the fascinating world of using machine learning to uncover market anomalies!

Contents

- 1 Using Machine Learning to Identify Market Anomalies

- 2 Key Takeaways: Using Machine Learning to Identify Market Anomalies

- 3 Frequently Asked Questions

- 3.1 1. How does machine learning help identify market anomalies?

- 3.2 2. What types of market anomalies can machine learning uncover?

- 3.3 3. Is machine learning more effective than traditional methods for identifying market anomalies?

- 3.4 4. Are there any limitations to using machine learning for identifying market anomalies?

- 3.5 5. How can businesses and investors leverage machine learning to identify market anomalies?

- 3.6 Market Anomalies【Dr. Deric】

- 4 Summary

Using Machine Learning to Identify Market Anomalies

Machine learning has revolutionized many industries, and the financial sector is no exception. One of the most valuable applications of machine learning in finance is the identification of market anomalies. Market anomalies refer to unusual or irregular patterns that deviate from the expected behavior of financial markets. These anomalies can provide valuable insights for investors and traders, helping them make more informed decisions and maximize their returns. In this article, we will explore how machine learning techniques can be used to identify market anomalies and explain why this is such a powerful tool in the financial world.

Understanding Market Anomalies

Market anomalies are deviations from the normal behavior of financial markets. These anomalies can occur due to various factors, such as unpredictable events, investor sentiment, or mispriced securities. Traditional financial models often struggle to capture and explain these anomalies, which can result in missed opportunities or unexpected losses for investors. Machine learning algorithms, on the other hand, excel at identifying and analyzing complex patterns in large datasets, making them ideal for detecting market anomalies.

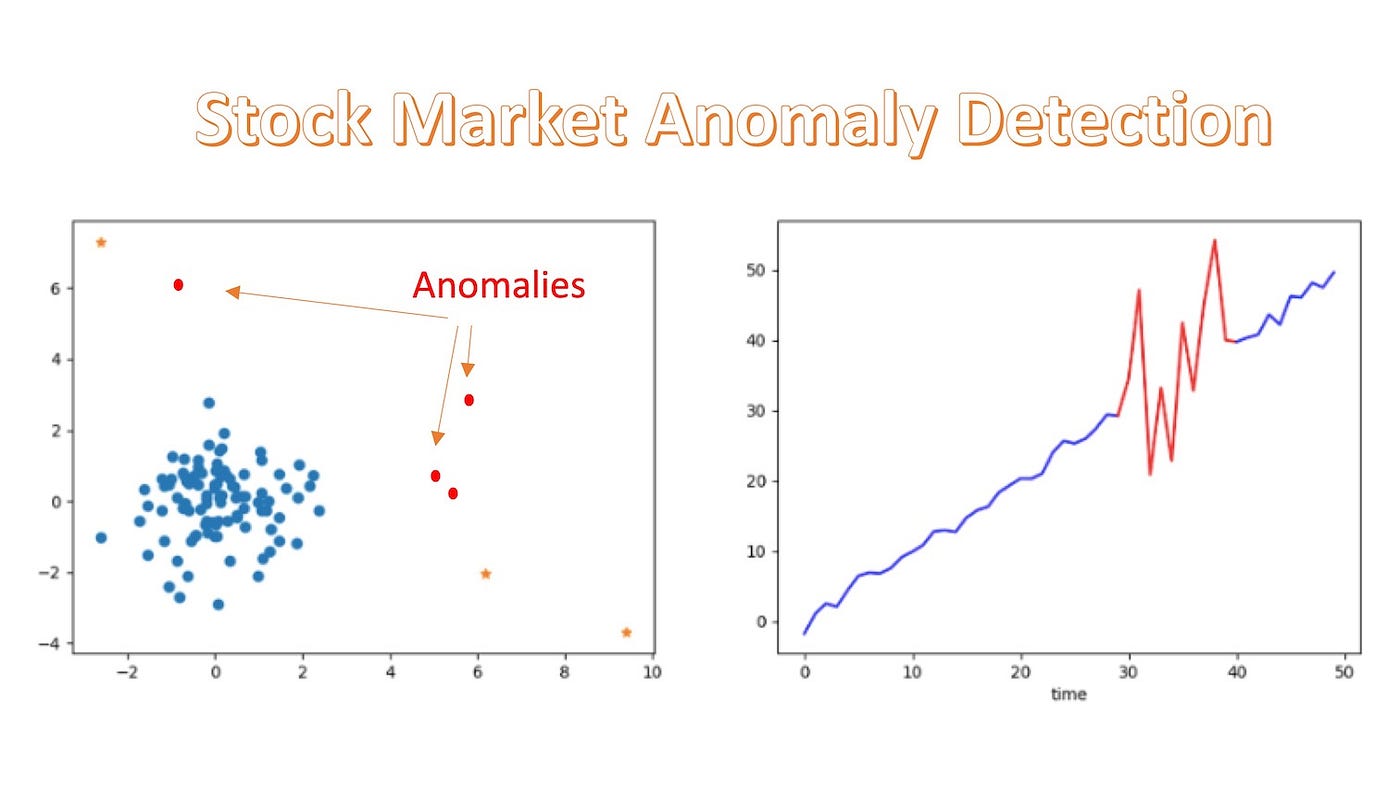

By analyzing historical market data, machine learning algorithms can identify patterns and relationships that are not easily visible to human analysts. These algorithms can detect abnormalities in trading volumes, price movements, or correlations between assets, among other factors. This allows investors to capitalize on market anomalies by taking advantage of mispriced securities or adjusting their investment strategies in response to unusual market behavior.

The Benefits of Using Machine Learning for Anomaly Detection

The use of machine learning for market anomaly detection offers several key benefits to investors and traders. Firstly, machine learning algorithms can analyze vast amounts of market data and identify anomalies in real-time. This allows investors to react quickly to changing market conditions and seize profitable opportunities. Additionally, machine learning algorithms can continuously learn and adapt to new market trends, improving their accuracy over time. This ensures that investors have access to the most up-to-date anomaly detection capabilities.

Furthermore, machine learning algorithms are not influenced by human biases or emotions, which can cloud judgment and lead to poor investment decisions. By eliminating human error, machine learning provides a more objective and reliable approach to identifying market anomalies. This can result in higher returns and reduced risk for investors. Lastly, machine learning algorithms can analyze a wide range of data sources, including news articles, social media sentiment, and economic indicators, providing a comprehensive view of market conditions and potential anomalies.

Machine Learning Techniques for Anomaly Detection

There are various machine learning techniques that can be used to detect market anomalies. One common approach is the use of clustering algorithms, which group similar data points together based on their characteristics. Anomalies can then be identified as data points that deviate significantly from the clusters. Another technique is the use of supervised learning algorithms, which are trained on labeled data to classify anomalies based on predefined criteria.

Another effective approach is time series analysis, where historical market data is analyzed to identify abnormal patterns or trends. Recurrent neural networks, a type of artificial neural network designed for processing sequential data, are commonly used for time series analysis in anomaly detection. These networks can capture complex temporal dependencies and identify anomalies based on deviations from expected patterns.

Challenges and Considerations

While machine learning offers significant advantages in identifying market anomalies, there are also challenges and considerations to be aware of. One challenge is the potential for overfitting, where algorithms become too specialized in the training data and fail to generalize well to new data. To mitigate this, it is important to regularly update and retrain machine learning models with fresh data to ensure accuracy and adaptability.

Another consideration is the need for high-quality and reliable data. Machine learning algorithms rely on accurate and comprehensive data to effectively identify anomalies. Incomplete or inaccurate data can lead to false positives or false negatives. It is essential to have robust data collection and preprocessing techniques in place to ensure the integrity and quality of the data used in anomaly detection.

Tips for Successful Anomaly Detection Using Machine Learning

To enhance the effectiveness of anomaly detection using machine learning, here are some tips to keep in mind:

- Start with a well-defined problem statement and clear objectives for anomaly detection.

- Regularly update and retrain machine learning models to adapt to changing market conditions.

- Ensure the availability of high-quality and reliable data for accurate anomaly identification.

- Combine multiple machine learning techniques to increase the robustness of anomaly detection.

- Validate and test machine learning models using real-world market data to evaluate their performance.

Conclusion

Using machine learning to identify market anomalies is a powerful tool for investors and traders. By leveraging machine learning algorithms, investors can detect unusual patterns and deviations in financial markets, gaining valuable insights and opportunities. However, it is important to consider the challenges and considerations associated with machine learning, such as overfitting and data quality issues. By following best practices and incorporating tips for successful anomaly detection, investors can unlock the full potential of machine learning in the world of finance.

Key Takeaways: Using Machine Learning to Identify Market Anomalies

- Machine learning can help identify unusual patterns in financial markets.

- It involves analyzing large amounts of historical data to find anomalies.

- This technology can assist in detecting market manipulation or fraud.

- Using machine learning can enhance risk assessment and decision-making.

- Implementing machine learning requires expertise in data analysis and modeling.

Frequently Asked Questions

Welcome to our FAQ section on using machine learning to identify market anomalies. Here, we have compiled the most commonly asked questions to help you understand this fascinating topic better. Read on to find answers that will shed light on how machine learning can uncover market irregularities.

1. How does machine learning help identify market anomalies?

Machine learning algorithms can analyze vast amounts of financial data to identify patterns and trends that may not be easily noticeable to humans. By training models on historical market data, machine learning can detect anomalies in real-time trading, such as sudden price changes or abnormal trading volumes. This technology allows traders and investors to react swiftly to market anomalies and make informed decisions.

Furthermore, machine learning algorithms can adapt and learn from new data, continuously improving their anomaly detection capabilities. This makes them valuable tools for detecting previously unseen and emerging market irregularities.

2. What types of market anomalies can machine learning uncover?

Machine learning algorithms can uncover various types of market anomalies. These can include, but are not limited to:

– Price anomalies: Unexpected and significant changes in the price of a stock or other financial instrument.

– Volume anomalies: Unusually high or low trading volumes that deviate from the norm.

– Liquidity anomalies: Sudden shifts in supply and demand, causing liquidity imbalances.

– Momentum anomalies: Unexpected shifts in price momentum, indicating possible future market movements.

– News-based anomalies: Identification of market reactions to news articles, social media sentiment, or other external factors.

By applying machine learning techniques, these anomalies can be detected in real-time, providing valuable insights for traders and investors.

3. Is machine learning more effective than traditional methods for identifying market anomalies?

Machine learning has proven to be highly effective in identifying market anomalies. Traditional methods of anomaly detection often rely on predefined rules or statistical models, which may not capture the complexity and nuances of financial markets. Machine learning, on the other hand, can analyze vast amounts of data and discover intricate patterns that might go unnoticed with conventional approaches.

Moreover, machine learning algorithms can continually learn and adapt to new data, improving their anomaly detection capabilities over time. This adaptive nature gives them an advantage over static rule-based systems, making them highly effective tools for identifying market irregularities.

4. Are there any limitations to using machine learning for identifying market anomalies?

While machine learning is a powerful tool for identifying market anomalies, it has some limitations. Firstly, the accuracy of anomaly detection relies heavily on the quality and relevance of the data used to train the models. If the training data is incomplete or biased, it may lead to inaccurate anomaly predictions.

Secondly, machine learning models are not foolproof and can sometimes produce false positives or false negatives. This means that they may mistakenly identify normal market behavior as an anomaly, or fail to detect actual anomalies, respectively. Constant monitoring and validation are necessary to ensure reliable anomaly detection.

5. How can businesses and investors leverage machine learning to identify market anomalies?

Businesses and investors can leverage machine learning to identify market anomalies in various ways. They can build their anomaly detection systems or use third-party tools that incorporate machine learning algorithms. By analyzing real-time market data and identifying anomalies, they can make better-informed trading or investment decisions.

Machine learning can also be used to automate trading strategies based on market anomaly detection. Traders can create algorithms that execute trades when specific anomalies are identified, allowing for faster and more efficient response to market irregularities.

Market Anomalies【Dr. Deric】

Summary

So, to wrap things up: Machine learning can help us find strange things happening in the market. It uses fancy algorithms to analyze lots of data and spot anomalies. By identifying these anomalies, we can make better choices and avoid losing money. Machine learning is like having a super-smart detective that helps us understand what’s going on in the stock market. It’s pretty cool, right?

But remember, even with all this fancy technology, investing in the stock market still involves risks. So be careful and don’t put all your eggs in one basket. Happy investing!