Machine Learning for Predicting Stock Market Trends

When it comes to the stock market, predicting trends can be challenging. But what if there was a way to use technology to gain an edge? That’s where machine learning comes in.

Machine learning is like having a super-smart assistant that analyzes massive amounts of data to identify patterns and make predictions. It can help investors make more informed decisions and potentially increase their chances of success.

By applying machine learning algorithms to historical stock market data, we can uncover hidden insights and forecast future trends. It’s like having a crystal ball that guides us in making smarter investment choices. So, let’s dive into the fascinating world of machine learning for predicting stock market trends and discover how it can revolutionize the way we invest.

Discover how this cutting-edge technology can assist in forecasting stock market movements. Using advanced algorithms, machine learning analyzes vast amounts of data to identify patterns and predict future trends. By leveraging historical prices, market indicators, and other relevant factors, machine learning models can make accurate predictions. Stay ahead in the market with this powerful tool.

Contents

- 1 Machine Learning for Predicting Stock Market Trends

- 2 Understanding Machine Learning Algorithms

- 3 Machine Learning Techniques for Stock Market Prediction

- 4 Conclusion

- 5 Key Takeaways: Machine Learning for Predicting Stock Market Trends

- 6 Frequently Asked Questions

- 6.1 Q: How does machine learning help predict stock market trends?

- 6.2 Q: What are the benefits of using machine learning for predicting stock market trends?

- 6.3 Q: Can machine learning accurately predict stock market trends?

- 6.4 Q: Do I need programming skills to use machine learning for predicting stock market trends?

- 6.5 Q: Are machine learning predictions always reliable for making investment decisions?

- 6.6 Stock Market Prediction Using Machine Learning | Machine Learning Tutorial | Simplilearn

- 7 Summary

Machine Learning for Predicting Stock Market Trends

Welcome to our article on Machine Learning for Predicting Stock Market Trends. In this guide, we will explore how machine learning algorithms are revolutionizing the way we predict stock market trends. With the advancement in technology and the availability of vast amounts of data, machine learning has become a powerful tool for investors and traders to gain insights and make informed decisions in the unpredictable world of the stock market.

Understanding Machine Learning Algorithms

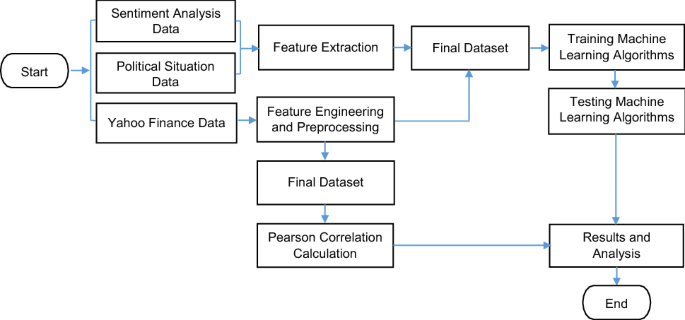

Machine learning algorithms are designed to analyze and interpret large datasets to identify patterns and make predictions. In the context of stock market trends, these algorithms can be trained on historical stock market data to learn how different factors influence stock prices and identify trends that can help investors make better decisions. They can analyze various data points such as company financials, industry trends, news sentiment, and market indicators to generate predictions on future stock prices.

One of the most popular machine learning techniques used in stock market prediction is the use of artificial neural networks. These networks are inspired by the structure of the human brain and consist of layers of interconnected nodes, also known as neurons. Each neuron processes information from the previous layer and passes it on to the next layer. By adjusting the weights and biases of these neurons, the neural network can learn and make predictions based on the patterns it identifies in the input data.

The Benefits of Machine Learning in Stock Market Prediction

Machine learning algorithms offer several advantages when it comes to predicting stock market trends. Firstly, they can analyze vast amounts of data much faster than humans, allowing investors to make timely decisions. Secondly, they can detect complex patterns and relationships that may be missed by human analysts, leading to more accurate predictions. Additionally, machine learning algorithms can continuously learn and improve from new data, adapting to changing market conditions and providing valuable insights for investors.

Another benefit of using machine learning for stock market prediction is the ability to handle non-linear relationships between variables. Traditional statistical models often assume linear relationships, which may not capture the complexities of the stock market. Machine learning algorithms, on the other hand, can detect and exploit non-linear relationships, providing a more comprehensive understanding of the underlying factors that influence stock prices.

Furthermore, machine learning algorithms can handle large and unstructured datasets. With the abundance of news articles, social media feeds, and other unstructured data sources, machine learning algorithms can extract relevant information and analyze sentiment to assess market sentiment accurately. This enables investors to gain a deeper understanding of market trends and make more informed investment decisions.

Challenges and Limitations of Machine Learning in Stock Market Prediction

While machine learning algorithms have shown promising results in predicting stock market trends, there are also some challenges and limitations to be aware of. Firstly, financial markets are influenced by numerous factors, including geopolitical events, economic indicators, and investor sentiment. Machine learning algorithms may struggle to capture the complexity and nuances of these factors, leading to less accurate predictions.

Another challenge is the prevalence of noisy and unreliable data in the financial markets. Financial data can be subject to errors, inconsistencies, and biases, which can impact the performance of machine learning algorithms. It is crucial to ensure the quality and reliability of the data used for training machine learning models to avoid misleading predictions.

Additionally, the stock market is inherently unpredictable, with no guarantee that historical patterns will repeat in the future. While machine learning algorithms can identify and exploit trends in the data, there is always a level of uncertainty associated with stock market predictions. It is essential for investors to consider these limitations and use machine learning predictions as a complementary tool rather than relying solely on them for investment decisions.

Machine Learning Techniques for Stock Market Prediction

Now let’s dive deeper into some of the specific machine learning techniques that are commonly used for stock market prediction. These techniques leverage different algorithms and approaches to analyze historical data and generate predictions on future stock prices.

Recurrent Neural Networks (RNNs)

Recurrent Neural Networks (RNNs) are a type of artificial neural network that is well-suited for sequential data, such as time series data in the stock market. RNNs have a feedback loop that allows information to be passed from one step to the next, enabling them to capture temporal dependencies in the data. This makes them ideal for predicting stock market trends, as past stock prices and trends can significantly influence future prices.

RNNs can analyze historical stock market data, including price movements, trading volumes, and other relevant variables, to learn the patterns and trends in the data. This knowledge can then be used to make predictions on future stock prices. The use of RNNs in stock market prediction has shown promising results, although there are still challenges in training and optimizing these models effectively.

Support Vector Machines (SVMs)

Support Vector Machines (SVMs) are another popular technique used in stock market prediction. SVMs aim to find the optimal hyperplane that separates data points of different classes in a high-dimensional space. In the context of stock market prediction, SVMs can learn from historical data to classify stock price movements as either positive or negative.

SVMs can handle complex data patterns and are robust to noisy data, making them suitable for stock market prediction. They can analyze various features such as technical indicators, market sentiment data, and historical price data to classify future price movements. However, SVMs may struggle with highly volatile and unpredictable market conditions, as finding an optimal hyperplane in such cases can be challenging.

Ensemble Methods

Ensemble methods combine multiple machine learning models to improve prediction accuracy and reduce the risk of overfitting to the training data. In the context of stock market prediction, ensemble methods can be used to combine the predictions of multiple models, each trained on a different subset of the data or using different algorithms.

Popular ensemble methods include Random Forests and Gradient Boosting. These methods leverage the wisdom of crowds, where the collective predictions of multiple models tend to outperform individual models. Ensemble methods are especially useful in stock market prediction, where the combination of different perspectives and approaches can lead to more accurate predictions.

Conclusion

Machine learning algorithms have become invaluable tools for predicting stock market trends. They offer several benefits, including the ability to analyze vast amounts of data, detect complex patterns, and adapt to changing market conditions. However, there are also challenges and limitations that need to be considered when using machine learning for stock market prediction.

Recurrent Neural Networks, Support Vector Machines, and Ensemble Methods are just a few examples of the machine learning techniques used in stock market prediction. Each technique has its strengths and limitations, and it is crucial to select the most suitable approach based on the specific requirements and characteristics of the stock market being analyzed.

In conclusion, the combination of machine learning algorithms and human expertise can lead to more accurate predictions and informed investment decisions. By leveraging the power of machine learning, investors and traders can navigate the complex world of the stock market with confidence.

Key Takeaways: Machine Learning for Predicting Stock Market Trends

- Machine learning uses algorithms to analyze large amounts of data and make predictions about stock market trends.

- By training machine learning models with historical stock market data, it can identify patterns and make accurate predictions.

- Machine learning can help investors make informed decisions by providing insights into future stock market movements.

- However, it’s important to remember that stock market predictions are not always 100% accurate and should be used as a tool, not the sole basis for investment decisions.

- Machine learning for predicting stock market trends is a complex field that requires expertise in both finance and data analysis.

Frequently Asked Questions

Machine learning is revolutionizing the stock market by enabling predictive analysis. Here are some commonly asked questions about machine learning for predicting stock market trends:

Q: How does machine learning help predict stock market trends?

Machine learning algorithms can analyze vast amounts of historical data to identify patterns and trends in stock prices. By training on historical data and continuously learning from new data, these algorithms can make predictions about future stock market movements. They take into account various factors such as price history, trading volumes, and market sentiment to generate forecasts.

Machine learning algorithms can also adapt and improve over time as they gain more data and learn from their mistakes. This ability to constantly evolve makes machine learning a powerful tool for predicting stock market trends.

Q: What are the benefits of using machine learning for predicting stock market trends?

Using machine learning for predicting stock market trends offers several advantages. Firstly, it can handle large amounts of data efficiently, analyzing multiple variables simultaneously. This enables it to capture complex relationships that may not be apparent to human analysts.

Secondly, machine learning can process information in real-time, allowing for quick adaptation to changing market conditions. It can identify and respond to emerging trends faster than traditional models. Lastly, machine learning algorithms can operate without human bias, basing predictions solely on data-driven insights rather than subjective opinions.

Q: Can machine learning accurately predict stock market trends?

While machine learning algorithms have shown promise in predicting stock market trends, it’s important to understand that no prediction method is 100% accurate. Stock markets are influenced by a multitude of factors, including geopolitical events, economic indicators, and investor sentiments, making them inherently unpredictable.

However, machine learning algorithms can provide valuable insights and improve the accuracy of predictions compared to traditional methods. They can identify subtle correlations and patterns that may be missed by human analysts, enhancing the overall accuracy of stock market trend predictions.

Q: Do I need programming skills to use machine learning for predicting stock market trends?

While having programming skills can be beneficial for leveraging machine learning algorithms to predict stock market trends, it’s not necessarily a requirement. There are user-friendly machine learning platforms and tools available that allow individuals without extensive programming knowledge to apply these techniques.

These platforms often provide pre-built models and user interfaces that simplify the process of training and deploying machine learning algorithms. They often come with intuitive graphical interfaces that allow users to input data, select algorithms, and interpret results without the need for extensive coding.

Q: Are machine learning predictions always reliable for making investment decisions?

Machine learning predictions should be used as a tool for making informed investment decisions, but they should not be the sole basis for such decisions. It’s essential to combine machine learning insights with other fundamental and technical analysis techniques.

Machine learning models are trained on historical data and patterns, but the future may not always resemble the past. Factors such as unforeseen events or sudden market shifts can impact stock prices in unpredictable ways. Therefore, it’s crucial to consider machine learning predictions in conjunction with expert advice, market research, and a comprehensive understanding of the stock market.

Stock Market Prediction Using Machine Learning | Machine Learning Tutorial | Simplilearn

Summary

So, to sum it up, machine learning can help us predict stock market trends. By analyzing a lot of data and finding patterns, computers can make educated guesses about future movements. However, it’s important to remember that these predictions aren’t always accurate, and investing in the stock market still carries risks. So, be cautious and do your research before making any financial decisions. Machine learning is a powerful tool, but it’s not a crystal ball.