Welcome to the world of Yield Farming! You might be wondering, “The Mechanics of Yield Farming: How Does It Work?” Well, let’s dive in and find out!

Yield Farming is like a virtual garden where you can grow your cryptocurrency by lending or staking it. Think of it as planting seeds and watching your money grow. But instead of watering your plants, you earn more crypto as a reward!

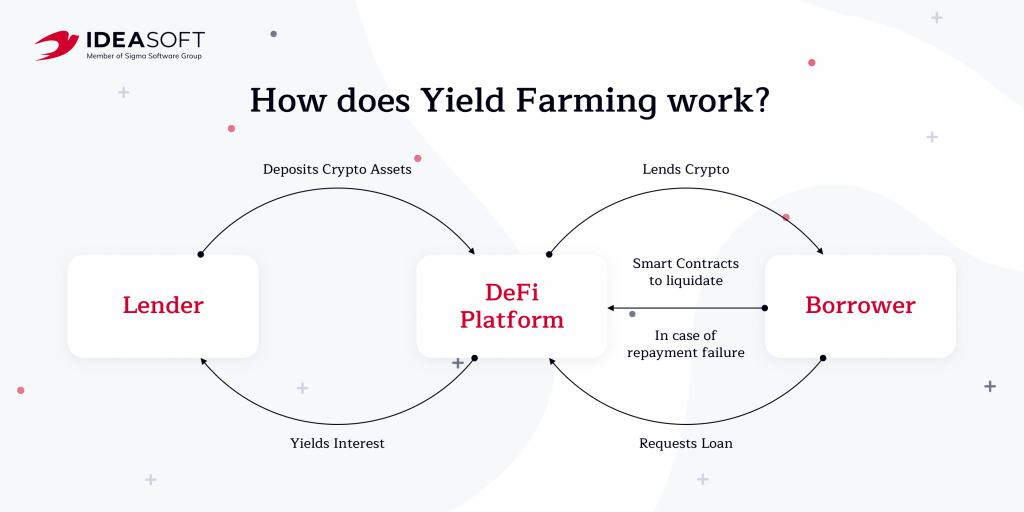

Here’s how it works: When you lend or stake your cryptocurrency in a Yield Farming protocol, you become a liquidity provider. You’re essentially lending your funds to the protocol, allowing others to borrow or trade with them. In return, you earn interest or rewards in the form of more cryptocurrency. It’s like getting free crops for tending to your virtual garden!

So, whether you’re a seasoned investor or just starting out, Yield Farming provides an exciting opportunity to put your idle cryptocurrency to work and earn passive income. Now that we’ve got the basics covered, let’s explore the fascinating world of Yield Farming and discover how you can make the most out of it!

Stay tuned as we unravel the intricacies of Yield Farming and learn valuable tips and tricks to maximize your earnings. Get ready to become a savvy crypto farmer, cultivating your virtual riches with the mechanics of Yield Farming! Let’s get started!

1. Choose a reliable DeFi platform.

2. Select the assets you want to provide as liquidity.

3. Deposit your assets into the liquidity pool.

4. Receive liquidity pool tokens in return.

5. Use these tokens to earn rewards through various mechanisms like staking or lending.

By following these steps, you can start yield farming and maximize your cryptocurrency earnings.

Contents

- 1 The Mechanics of Yield Farming: How Does It Work?

- 2 Understanding Yield Farming: An Introduction

- 3 Best Practices for Successful Yield Farming

- 4 Conclusion

- 5 Key Takeaways: The Mechanics of Yield Farming

- 6 Frequently Asked Questions

- 6.1 1. What is yield farming and how does it work?

- 6.2 2. What are the risks associated with yield farming?

- 6.3 3. Which platforms offer yield farming opportunities?

- 6.4 4. How can I choose the right yield farming strategy?

- 6.5 5. Are there any additional costs or fees associated with yield farming?

- 6.6 Yield Farming Simplified: How It Works And Major Risks Explained

- 7 Summary:

The Mechanics of Yield Farming: How Does It Work?

Welcome to our in-depth guide on the mechanics of yield farming! Yield farming has become increasingly popular, especially in the world of decentralized finance (DeFi). In this guide, we will explore the intricacies of yield farming and discover how it works. Whether you’re a seasoned investor or new to the world of DeFi, this guide will help you understand the mechanics behind yield farming and empower you to make informed investment decisions.

Understanding Yield Farming: An Introduction

Before diving into the mechanics of yield farming, let’s first understand what it actually means. Yield farming is a practice that allows cryptocurrency holders to generate additional returns on their holdings by lending or staking their assets in decentralized platforms. It involves providing liquidity to these platforms and being rewarded with yield or additional tokens in return. Yield farming typically takes place on decentralized exchanges (DEXs) and automated market makers (AMMs) that utilize smart contracts to facilitate transactions in a trustless and secure manner.

What Are the Key Components of Yield Farming?

Yield farming involves several key components that determine how it functions. These components include:

- Liquidity Pools: Liquidity pools are where users contribute their assets to provide liquidity for trading on decentralized platforms. These pools are created using smart contracts and enable users to lend, borrow, or trade assets.

- Staking: Staking refers to the act of locking up your funds in smart contracts to support the operation of a decentralized platform. By staking your assets, you contribute to the security and stability of the network and are rewarded with additional tokens.

- Yield Aggregators: Yield aggregators are platforms that automatically farm for the highest yield across multiple decentralized platforms. They optimize returns by moving funds between different pools and protocols, saving users time and effort.

By understanding these key components, you can better grasp how yield farming operates and leverage its potential benefits.

The Process of Yield Farming: Step by Step

Now let’s walk through the step-by-step process of yield farming to gain a deeper understanding:

- Selecting the Platform: Start by choosing a reputable decentralized platform for yield farming. Research different platforms and consider factors such as security, user experience, and available incentives.

- Choosing the Assets: Determine which assets you want to farm. These can be cryptocurrencies, stablecoins, or liquidity provider (LP) tokens.

- Providing Liquidity: If you choose to provide liquidity, deposit your assets into a liquidity pool. This will involve creating an LP token that represents your share of the pool.

- Earning Rewards: Once you have provided liquidity, you will start earning rewards in the form of interest, fees, or additional tokens. The specific rewards will depend on the platform and the assets you have staked.

- Monitoring and Managing: Continuously monitor your yield farming position and make adjustments as necessary. Stay informed about APRs (Annual Percentage Rates) and potential risks to maximize your returns.

This step-by-step process will guide you in getting started with yield farming and help you make informed decisions throughout your farming journey.

The Risks and Rewards of Yield Farming

While yield farming offers the potential for high returns, it’s important to be aware of the risks involved. Some of the risks include:

- Impermanent Loss: When providing liquidity in a pool, the value of your assets may fluctuate. This can result in impermanent loss, where the value of your assets is lower compared to if you had simply held them.

- Smart Contract Risks: Yield farming relies on smart contracts, which can be vulnerable to security breaches, bugs, or hacks. It’s crucial to choose platforms with audited and reputable smart contracts to mitigate these risks.

- Market Volatility: The cryptocurrency market is highly volatile, and this volatility can impact the value of the assets you stake or the rewards you earn.

Despite these risks, yield farming can also offer attractive rewards, such as:

- High APYs: Yield farming can provide significantly higher annual percentage yields (APYs) compared to traditional financial instruments.

- Additional Tokens: Many yield farming platforms reward users with additional tokens, allowing them to participate in new projects and potentially generate more profits.

- Community Engagement: Yield farming often involves active participation in decentralized communities, providing opportunities to learn, network, and contribute to the growth of the ecosystem.

Understanding both the risks and rewards is essential for successful yield farming and managing your investment portfolio effectively.

Best Practices for Successful Yield Farming

Now that we have explored the mechanics of yield farming, here are some best practices to maximize your farming experience:

- Research and Due Diligence: Thoroughly research the platforms, pools, and projects you are considering for yield farming. Look for audits, security measures, and community feedback to make informed decisions.

- Diversify Your Investments: Avoid putting all your eggs in one basket and diversify your yield farming strategies across different platforms, pools, and assets. This can help mitigate risks and optimize returns.

- Stay Updated: Keep up with industry news, developments, and updates. Understanding market trends and changes will help you adapt your farming strategies and stay competitive.

- Start Small: If you’re new to yield farming, start with a small amount until you feel comfortable with the process and have a better understanding of the risks involved.

- Understand Fees and Costs: Be aware of the fees associated with yield farming, such as transaction fees, withdrawal fees, and gas fees. Consider these costs when calculating your potential returns.

By following these best practices, you can enhance your farming experience and increase your chances of success in the dynamic world of yield farming.

Conclusion

Yield farming has revolutionized the crypto space, offering new opportunities for investors to generate additional returns on their assets. By understanding the mechanics of yield farming, you can navigate this intricate landscape with confidence and make informed investment decisions. Remember to conduct thorough research, diversify your investments, and stay updated with industry trends to optimize your farming experience. Yield farming can be both rewarding and risky, so exercise caution and start with small investments until you gain more experience. Happy farming!

Key Takeaways: The Mechanics of Yield Farming

- Yield farming is a way to earn passive income by lending or staking cryptocurrency.

- It works by participating in decentralized finance (DeFi) platforms and providing liquidity to the ecosystem.

- Yield farmers can earn rewards in the form of additional tokens or fees for their contributions.

- However, yield farming carries risks, including impermanent loss and smart contract vulnerabilities, so it’s important to do thorough research before participating.

- Overall, yield farming can be a profitable investment strategy, but it’s crucial to understand how it works and the risks involved.

Frequently Asked Questions

Welcome to our frequently asked questions about the mechanics of yield farming and how it works. Below are some common queries and their detailed answers to help you understand this concept better.

1. What is yield farming and how does it work?

Yield farming is a decentralized finance (DeFi) strategy that allows individuals to earn passive income by lending or providing liquidity to crypto assets on various platforms. It involves staking or locking up these assets in smart contracts to receive rewards in the form of additional tokens.

For example, let’s say you hold a certain cryptocurrency. By depositing (or “staking”) it in a liquidity pool, you contribute to the liquidity available for that token. In return, you receive interest or fees from the pool as a reward for your contribution. These rewards are typically distributed in the form of different tokens, which you can then sell or reinvest to compound your returns.

2. What are the risks associated with yield farming?

While yield farming can be lucrative, it’s important to understand the risks involved. The main risks include impermanent loss, smart contract vulnerabilities, and market volatility.

Impermanent loss occurs when the value of the tokens you’ve provided liquidity for changes significantly. As a result, you may end up with fewer tokens than you initially had, even after considering the rewards earned. Smart contract vulnerabilities can expose your funds to hacking or other malicious activities, so it’s crucial to choose reputable platforms and conduct thorough research. Additionally, the crypto market can be highly volatile, leading to fluctuations in token prices and potentially affecting your earnings.

3. Which platforms offer yield farming opportunities?

There are several platforms that offer yield farming opportunities, including decentralized exchanges (DEXs), automated market makers (AMMs), and lending protocols. Some popular ones include Compound, Aave, Uniswap, SushiSwap, and Balancer. Each platform has its own set of rules and rewards structure, so it’s essential to familiarize yourself with the platform’s specific terms and conditions before getting started.

Additionally, it’s worth noting that new platforms and projects often emerge in the rapidly evolving DeFi space. Therefore, keeping up with the latest developments and conducting thorough research is crucial to identifying the most reliable and profitable yield farming opportunities.

4. How can I choose the right yield farming strategy?

Choosing the right yield farming strategy depends on various factors, such as your risk tolerance, knowledge of the project, and expected returns. It’s essential to assess the credibility and security of the platform, as well as the potential rewards and risks involved.

Furthermore, diversification is key. By allocating your funds across multiple platforms or pools, you can minimize the impact of potential losses on a single platform. Staying informed about the latest trends and market conditions is also crucial for making informed decisions in yield farming.

5. Are there any additional costs or fees associated with yield farming?

Yes, there are additional costs and fees associated with yield farming. These may include gas fees or transaction fees incurred when interacting with smart contracts on the blockchain network. Depending on the platform and the network’s congestion, these fees can vary in amount.

It’s important to consider these fees while calculating potential profits and deciding whether the overall returns justify the costs involved. Additionally, be mindful of the tax implications of earning income through yield farming, as tax regulations vary in different jurisdictions.

Yield Farming Simplified: How It Works And Major Risks Explained

Summary:

Yield farming is like a virtual farming game, but with real money! It involves lending or staking your crypto to earn rewards. Different platforms offer various farming opportunities, and the concept is to maximize profits by moving assets around. However, be cautious of the risks involved and do your research before getting started.

Just like a farmer tends to crops for income, yield farmers lend or stake their crypto to earn rewards. You can participate in yield farming by choosing a platform, depositing your assets, and earning a yield. Make sure to understand the risks and rewards before jumping in! Keep in mind that farming may not always be profitable, so do your due diligence and happy farming!