Is Crypto Still a Good Investment? If you’ve been wondering about the potential of investing in cryptocurrency, you’re not alone. Cryptocurrency has taken the financial world by storm, but is it still a profitable venture? Let’s dive in and explore this fascinating topic together!

In recent years, cryptocurrencies like Bitcoin and Ethereum have gained immense popularity, attracting both seasoned investors and newcomers seeking to capitalize on the digital currency revolution. With its decentralized nature and potential for high returns, crypto has certainly piqued the interest of many. However, as with any investment, it’s important to carefully evaluate the risks and rewards before diving in headfirst.

But fear not, young reader, we’re here to guide you through the world of crypto investments and decipher whether it’s still a wise choice in today’s ever-changing financial landscape. So, grab your virtual backpack and join us on this adventure as we uncover the secrets behind the enigmatic world of cryptocurrency! Let’s get started!

Wondering if investing in cryptocurrency is still a wise choice? While it’s true that the crypto market can be volatile, there are several factors to consider. First, assess your risk tolerance and financial goals. Then, examine market trends, industry developments, and regulations. Additionally, diversify your portfolio to mitigate risk. Keep in mind that investing in crypto requires careful research and knowledge. Ultimately, with a strategic approach and thorough understanding, crypto has the potential to be a good investment opportunity.

Contents

- 1 Is Crypto Still a Good Investment?

- 2 The Rise and Fall of Cryptocurrency: A Brief History

- 3 Understanding Market Trends: A Look into the Future

- 4 Investing in Cryptocurrency: Mitigating Risks and Maximizing Opportunities

- 5 Key Takeaways: Is Crypto Still a Good Investment?

- 6 Frequently Asked Questions

- 6.1 1. How has the value of cryptocurrencies evolved over time?

- 6.2 2. Is cryptocurrency a safe investment option?

- 6.3 3. What factors should I consider before investing in cryptocurrencies?

- 6.4 4. Does the future hold promise for cryptocurrencies?

- 6.5 5. How can I mitigate the risks associated with cryptocurrency investments?

- 6.6 Should I Invest In Cryptocurrency?

- 7 Summary

Is Crypto Still a Good Investment?

Cryptocurrency has taken the financial world by storm in recent years. As the value of digital currencies like Bitcoin and Ethereum skyrocketed, many people jumped on the bandwagon in hopes of striking it rich. However, as with any investment, the question of whether crypto is still a good investment remains. In this article, we will explore the current state of the cryptocurrency market, examine the potential risks and rewards, and provide valuable insights to help you make an informed decision.

The Rise and Fall of Cryptocurrency: A Brief History

The history of cryptocurrency is marked by significant fluctuations in value and investor interest. Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an anonymous individual or group known as Satoshi Nakamoto. It gained popularity as a decentralized digital currency, offering secure and anonymous transactions. Over the years, more cryptocurrencies emerged, each with its unique features and value propositions.

However, the cryptocurrency market experienced a major crash in 2018, with many coins losing a significant portion of their value. This caused skepticism among investors and raised questions about the long-term viability of digital currencies. Since then, the crypto market has shown signs of recovery, but the volatility remains a concern for potential investors.

Despite the unpredictable nature of cryptocurrency, it has also proven to be a lucrative investment for many. Early adopters of Bitcoin, for example, have seen extraordinary returns on their investments. This raises the question: is crypto still a good investment?

The Potential Benefits of Investing in Cryptocurrency

1. **Diversification**: One of the key benefits of investing in cryptocurrency is diversification. Cryptocurrencies operate outside the traditional financial system and are not directly influenced by factors such as interest rates, inflation, or geopolitical tensions. This means that investors can potentially hedge against the risk associated with other asset classes.

2. **High Potential for Returns**: Cryptocurrencies have the potential to deliver significant returns on investment. With the right timing and strategy, investors can capitalize on price fluctuations and generate substantial profits. However, it’s important to note that these high potential returns come with equally high risks.

3. **Emerging Technology**: Cryptocurrencies are built on blockchain technology, which has the potential to revolutionize various industries. Investing in cryptocurrency allows individuals to support and participate in the development of decentralized applications and new financial systems.

The Risks and Challenges of Investing in Cryptocurrency

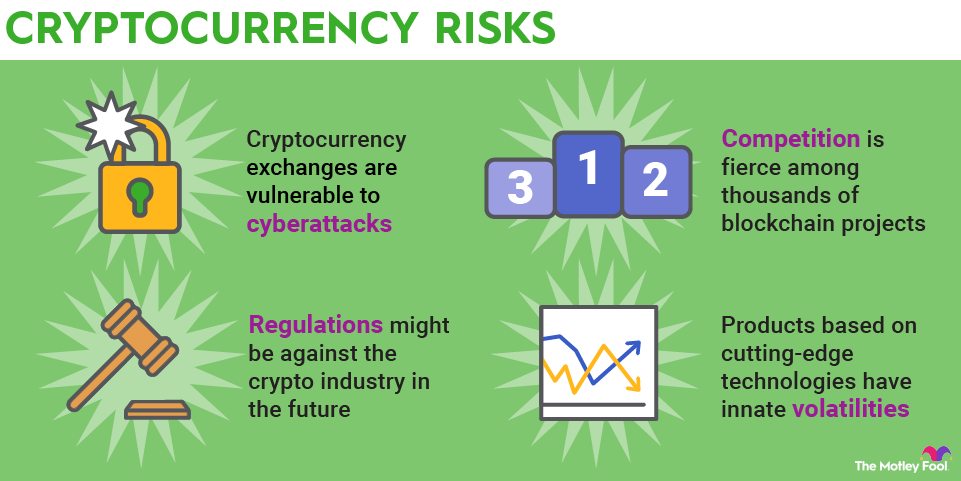

1. **Volatility**: Cryptocurrencies are notoriously volatile, with prices often experiencing rapid and significant fluctuations. This volatility can lead to substantial gains but also exposes investors to the risk of substantial losses. It requires a high-risk tolerance and a thorough understanding of market dynamics.

2. **Regulatory Uncertainty**: The regulation of cryptocurrencies is still evolving in many jurisdictions, creating uncertainty and potential legal risks for investors. Government crackdowns or regulations can have a significant impact on cryptocurrency prices and market sentiment.

3. **Security Concerns**: Holding and trading cryptocurrency involves cybersecurity risks. Hacking and theft are not uncommon in the crypto world, and investors need to take extra precautions to secure their digital assets.

4. **Lack of Transparency**: The crypto market is notorious for its lack of transparency. Manipulation, fraud, and misinformation can affect prices and investor confidence. Conducting thorough research and due diligence is crucial before making any investment decisions.

Strategies for Investing in Cryptocurrency

1. **Do Your Research**: Before investing in any cryptocurrency, it’s essential to thoroughly research the technology, team behind the project, and market conditions. Stay updated with the latest news and developments in the crypto space.

2. **Set Realistic Expectations**: Cryptocurrency investments should not be seen as get-rich-quick schemes. Set realistic expectations and be prepared for the potential risks and volatility associated with this asset class.

3. **Diversify Your Portfolio**: As with any investment, diversification is key to managing risk. Consider diversifying your cryptocurrency portfolio by investing in a range of coins and tokens with different use cases and market potential.

4. **Secure Your Investments**: Take steps to secure your digital assets. Use cold wallets and two-factor authentication to protect your cryptocurrencies from theft and hacking attempts.

5. **Consult with Professionals**: If you are unsure about investing in cryptocurrency, it may be beneficial to consult with financial professionals who have experience in the crypto market.

The Future of Cryptocurrency

While the future of cryptocurrency remains uncertain, it is undeniable that it has the potential to revolutionize the financial landscape. As blockchain technology continues to evolve and cryptocurrencies gain wider adoption, there will likely be both opportunities and challenges for investors. It’s essential to stay informed, assess your risk tolerance, and make investment decisions based on thorough research and careful consideration.

Understanding Market Trends: A Look into the Future

In this section, we will explore the current market trends and examine the factors that could impact the future of cryptocurrency as an investment.

1. The Growing Adoption of Cryptocurrency

As cryptocurrencies gain more mainstream acceptance, their adoption is likely to increase significantly. More businesses are starting to accept digital currencies as a form of payment, and institutional investors are entering the market. This growing adoption could drive demand and potentially lead to increased value for cryptocurrencies.

2. Government Regulations and Legal Frameworks

The regulatory landscape for cryptocurrencies is constantly evolving. Governments around the world are attempting to navigate the challenges presented by digital currencies while protecting investor interests and preventing illegal activities. The development of clear regulations and legal frameworks could help stabilize the crypto market and increase investor confidence.

3. Technological Advancements

The underlying blockchain technology of cryptocurrencies is still in its infancy. As the technology continues to evolve, we can expect advancements that enhance scalability, security, and usability. These technological improvements could drive further adoption and increase the utility of cryptocurrencies.

4. Integration with Traditional Financial Systems

As the crypto market becomes more mature, we may see increased integration with traditional financial systems. This integration could lead to greater stability and acceptance of cryptocurrencies as legitimate investment assets. It could also provide more avenues for institutional investors to enter the market.

Investing in Cryptocurrency: Mitigating Risks and Maximizing Opportunities

Before investing in cryptocurrency, it’s important to assess your risk tolerance and carefully consider the potential rewards and challenges. Here are a few key strategies to mitigate risks and maximize opportunities when investing in cryptocurrency:

1. Diversify Your Portfolio

Investing in a variety of cryptocurrencies can help spread the risk and protect your investment from potential losses. Consider allocating your investment across different types of digital assets, including established cryptocurrencies and promising altcoins.

2. Stay Informed

Continuously educate yourself about the latest trends, news, and developments in the crypto market. Stay updated on regulatory changes, technological advancements, and market sentiment to make informed investment decisions.

3. Set Realistic Goals

Set realistic expectations for your cryptocurrency investments. Understand that the market is highly volatile, and significant price fluctuations can occur. Be patient and avoid making impulsive decisions based on short-term market movements.

4. Secure Your Investments

Take steps to protect your digital assets from theft and hacking. Use secure wallets, enable two-factor authentication, and follow best practices for cybersecurity. Keeping your investments safe is crucial in the world of cryptocurrency.

By following these strategies and keeping a level-headed approach, you can mitigate risks and maximize opportunities when investing in cryptocurrency. Remember, investing in digital currencies carries inherent risks, and it’s important to only invest what you can afford to lose. Cryptocurrency offers exciting possibilities, but it’s essential to approach it with caution and careful consideration.

Key Takeaways: Is Crypto Still a Good Investment?

Cryptocurrency can be a good investment opportunity, but it comes with risks.

Research and understand the market before investing in crypto.

Diversify your investment portfolio to reduce the risk associated with cryptocurrency.

Stay updated with the latest news and developments in the crypto world.

Invest only what you can afford to lose because the value of cryptocurrencies can be volatile.

Frequently Asked Questions

Wondering if cryptocurrency is still a good investment? Check out these commonly asked questions to find out more.

1. How has the value of cryptocurrencies evolved over time?

The value of cryptocurrencies, like Bitcoin and Ethereum, have seen significant ups and downs over time. In the early years, their values skyrocketed, attracting many investors. However, the market is highly volatile, and fluctuations are common. It’s important to research and understand the trends and factors that affect cryptocurrency values before investing.

While some cryptocurrencies have experienced tremendous growth, others have struggled. It’s crucial to consider the long-term potential, underlying technology, and market demand when assessing the value of a specific cryptocurrency.

2. Is cryptocurrency a safe investment option?

Investing in cryptocurrencies carries a certain level of risk. Due to the rapid market changes and lack of regulation, there is a higher chance of volatility and potential losses. It’s important to diversify your investment portfolio and only invest what you can afford to lose.

However, with careful research and risk management strategies, some investors have found success in the crypto market. It’s crucial to stay updated on industry news, secure your digital assets with reputable wallets, and be cautious of scams or fraudulent schemes.

3. What factors should I consider before investing in cryptocurrencies?

Before investing in cryptocurrencies, it’s important to consider factors such as the project’s team, technology, market demand, and competition. Evaluate the potential adoption, stability, and scalability of the cryptocurrency you’re interested in. Additionally, keep an eye on regulatory developments as they can significantly impact the market.

It’s also crucial to analyze your risk tolerance, investment goals, and time horizon. Cryptocurrency investments can be highly volatile, so be prepared for potential price swings. Consulting with a financial advisor can provide valuable insights and help you make informed investment decisions.

4. Does the future hold promise for cryptocurrencies?

The future of cryptocurrencies is still uncertain but holds promise. Blockchain technology, the foundation of cryptocurrencies, has shown potential for revolutionizing various industries. Many governments and financial institutions are actively exploring or implementing blockchain-based solutions.

Additionally, the increasing popularity of decentralized finance (DeFi) and digital currencies further indicate the growing acceptance and adoption of cryptocurrencies. However, it’s important to note that the market is still evolving, and it’s essential to thoroughly research and stay updated to identify potential opportunities.

5. How can I mitigate the risks associated with cryptocurrency investments?

To mitigate risks associated with cryptocurrency investments, it’s crucial to do thorough research on the project, team, and its underlying technology. Diversify your investments across different cryptocurrencies to spread the risk. Avoid investing more than you can comfortably afford to lose.

Additionally, protect your digital assets by using reputable and secure cryptocurrency wallets. Stay vigilant against phishing attempts, scams, and fraudulent schemes. Regularly update your knowledge about the latest market trends and regulatory developments to make informed investment decisions.

Should I Invest In Cryptocurrency?

Summary

So, is cryptocurrency still a good investment? Well, it’s hard to say for sure.

Crypto has the potential for big gains, but it’s also risky and volatile. You need to do your research, understand the risks, and only invest what you can afford to lose.

On the bright side, cryptocurrencies like Bitcoin have gained widespread acceptance, and blockchain technology holds promise for the future.

Ultimately, it’s up to you to decide if the potential rewards outweigh the risks. Just remember to be cautious and make informed decisions when investing in crypto.